|

Pallavi Research Scholar Guru Nanak Dev University, Amritsar |

Dr. Rishi Raj Sharma Astt. Prof., RC- Gurdaspur Guru Nanak Dev University, Amritsar |

The wide spread of media provides a lot of awareness among the public regarding all the changes and innovations that are taking place all around the globe. The technology when combined with the media makes it more easily to reach to the maximum number of customers. Therefore, the present paper intended to find the influence of the advertisement on the buying behavior towards banking and financial sector. The paper tries to explore the various factors which will affect the customers when they select the specific banking and financial services. Further, the paper will find the single factor which has the highest impact on the customers purchase decisions. The research objectives of the paper will be obtained by applying the Factor Analysis on the collected data and afterwards the regression analysis in order to find the relationship between the various factors and to identify the single prominent factor which has highest impact.

Keywords: Advertisement, Banking and Financial Services, Buying Behavior, Customer purchase decisions

Advertisement plays an important role in the society, and now financial sector is no exception to this. It generates the awareness between the consumers about the recent products which are being offered to them. It also creates a relationship between the company and the consumer. Advertisement helps Financial Institutions to makes an attempt to change or reinforce the attitude of the customer, reader and viewer towards the advertised products. Most of the advertisements creator intended to increase the sales of goods and further to establish a brand image in the mind of the customers. Therefore they had embedded message with factual information and various hidden intentions. Advertising can be used to change the views of the reader/viewer toward the product or service, to gain public opinion and political support by having some effect as desired by advertisers.

The next major consideration is how the advertisement plays an important role in the introduction of new products and services. This can be answered that advertisement helps to change the buyer’s attitude by introducing to some of the features, the process of manufacturing, how the design and packaging look like, what are the benefits that it will give to the customers when they will buy. (Sidhu, 2003 ).In order to deliver the desired message to the general public all the available media is used like print media, electronic media, internet resources etc. ( http://www.managementparadise.com).

The main objective of the present study is to analyze the major determinants which will have impact on the customers buying intention and play an important role in their decision. The paper is divided into critically examination of the literature available, data interpretation of the collected data with the help of questionnaire, application of the data analysis technique so as to withdraw the important factors from the collected data, analyzing of the results and the conclusion.

The competition in the financial services has increased a lot in the last decade. One of the probable reasons is the globalization. Carter et al (2001) explored the effect of the increasing globalization and its effect on the financial industry. In order to understand these effect the customer panel’s reports, sales technology tools and other important information parameters of the three financial firms GE Capital, Fidelity Investments in London and Morgan Stanley Dean Witter were examined.

In the time of high competition, the various firms try to attract the customers by adopting the various innovative and different features. Ryals (2001) explored the implementation of the advanced IT services in the financial services in UK. By adopting the more advanced IT services more and more customers will buy your products and it will help to maintain a strong customer relationship with the customers. By analysing the collected data with the means of the depth interviews, the study concluded that adopting the essential technology enabled services will result in the strong customer relationship as customer are benefited by the more advanced services.

The financial service provider should adopt the better distribution channels in order to reach maximum consumers. Gupta and Westal (1994 ) explored the relationships between pricing policy and distribution channels. The study determined the relationship between the tree parties manufacturer, distributor and the customer. Targeting to maximum customers is the foremost objective of the financial service provider but due to the constraint of the price dimensions, firms need to understand all these relationships and determine their strategies according to that.

Apart from the distribution channels, marketing is important. Ekerete (2005) analyzed the depth of the marketing strategies that are adopted by the banks present in the Nigeria. In order to fulfill the objective the data had been collected from depth interviews and the questionnaire. After analyzing the collected data, the results showed that there is a positive impact of the marketing activities on the profitability and image of the banks.

As more and more banks and financial service provider are there, it has resulted in the increased competition in the banking industry. Therefore, nowadays customer demands more portfolios of the banking services. Sadeghi and Bemani (2011) analyzed the banking service quality of the financial service providers in the strong competition. The data had been collected from the customers of the Eghtesad-e-Novin bank. The results of the study concluded that there bank understand their banking needs as per there expectation.

Ekankumo and Henry (2011) examined the relevance of sales Promotion strategies of the banking industry in Nigeria generally, and Bayelsa State specifically. It also attempted to evaluate the extent and relative impact of sales promotion on the development, growth, and survival of banks.

Hooman (2008) examined the hidden drivers for the price and quality factors behind the financial services. These factors were measured using the multi item scales for the six financial services. The results concluded that price seems to be the important parameter in the financial services. Also, consumer knowledge about the price and more and more advertisements exposure increased the knowledge of the customers about their financial service provider.

Lindholm (2008) examined whether customer behavior is influenced by the promotion activities in the case of the financial services. The post behavior of the respondents was analyzed by observing the credit card purchases in three segments pre purchase behavior, during and post purchase after the promotional periods.

As the markets are very dynamic therefore the manufacturers are interested in finding factors influencing attitude towards advertising. Past studies suggested that advertisement used by the individuals three basis purposes viz. information seeking, entertainment, social expression and may influence attitude towards advertising. Bamoriya and Singh (2011) investigated the role of the demographic variables with the information seeking behavior of the respondent. Also, the various sources of information that were used by the respondents.

We can define the term advertising as a form of communication intended to encourage buy or react on upon products, information, or services etc. Saleen S. (2011) investigated the relationship between variables which will affect the attitude and the emotion in the consumer buying behavior in the financial and banking products.

Imam A. (2011) analyzed the customers buying behavior in financial industry with special focus on Life insurance products. The study found that the customer satisfaction and behavior is important for any business to grow and achieve their objectives.

Nowadays more and more financial industry is depending upon the mobile phone for promotion and advertisement, for most of the operations. Dass and Pal (2011) analyzed the adoption of the mobile banking nowadays. The study analyzed the strength of the factors which play an important role through a scoring model.

Dogra (2012) analyzed the role of advertising on the investor’s behavior. The study specially focuses on the financial product mutual fund. The study concluded that consumer’s investment decisions are not based on the advertisement as high parameter of risk is associated in the mutual funds.

Some of the studies reveal that during the past few years the competition in banking industry have been growing in Iran, which resulted that banks find difficult to attain a big market share. Danaei (2013) analyzed the effect of advertisements on the willingness of the customers in case of the banking and financial services. The results of the study showed that customer awareness towards brand name affect the customer to willingly accept the banking services of that particular bank.

Mohammed (2012) explored the factors that play an important role in effectiveness of the online advertisements. The results of the study revealed that internet skills, advertisement content, advertisement location, income play an important role in the impact of the advertisement.

Financial advertizing includes advertizing performed by banks, financial institutions, insurance companies and investment companies. Mylonakis (2008) examined the role and objectives of financial advertizing and its impact on bank customers regarding specific banking products, like banking accounts, credit cards, consumer loans, housing loans, interviews and analyzed by content analysis techniques.

Beckett et al. (2000) purposed a model in order to describe the consumer behavior while the purchasing of financial services and products. The research finding showed that consumer purchasing behavior is to a great extent affected by the type of financial product being purchased. Further, the findings were examined to recognize suitable strategies which are helpful to increased customer maintenance and profitability.

Krishnan (1999) opined a model for evaluating the customer’s feedback into the final actions so that there will be improvement in overall customer satisfaction with financial services. The results of the study demonstrated that product offerings were the main parameter in satisfaction of the customer. Also the quality of telephone and branch services also influences the satisfaction.

Howcroft et.al (2010) examined the consumer purchase intentions, attitudes and motivation during the purchase of the financial products. The results revealed that the financial service provider should have better understanding of their customer behavior which influence their attitude while selection and then final purchase of financial products including the banking , insurance and investment products.

Izquierdo et al (2008) investigated the ways so that the customers can be converted into valued customers which remain loyal to financial service provider and bring new customers. The study found a strong relationship between consumer loyalty and the value which a client can obtain.

Advertising has become a part of our everyday life. Advertisement serves the purpose of a guide for ‘buying’ in which the intended message is delivered to masses through various media. A number of studies had been done which described the attitudes of the customers towards the financial service providers and their financial products. Some researchers have even discussed the role of advertising in persuading the consumers to choose a particular set of service. Even some studies could be cited out which have dwelled upon different marketing models in the developed nations as far as the marketing of financial services is concerned. But, there is dearth of literature in the studies related to the advertising in Banking and financial Sector and their impact upon the perceptual framing of the respondents and also upon the impact of these advertisements upon the purchase behavior of the respondents.

Objectives of the Study

The main objective of the research paper is to explore the respondent’s perception towards the financial service advertisements and to measure the impact of these advertisements on the purchase behavior of the respondents towards different financial products/ services advertised.

Convenience sampling technique was adopted. Surveyed customers consist of all those customers who had purchased financial products. The data had been collected from the Non Metro region- Mathura and metro region- New Delhi and Noida. 110 questionnaires were distributed out of which 92 were found completely filled by the respondents. Thus a total percentage of response rates were 83.6%.

The questionnaire was designed in such a way to collect information about the financial and banking products consumers had purchased and the role of various factors they considered while selecting banking and financial service provider. In order to achieve the above said objectives, likert type scaling was used; multiple choice questions were given to the respondent. The likert scale was divided into five dimensions [Strongly Agree (5) and Strongly Disagree (1)]. Twenty different statements were included in this category and most of these were derived from available literature from current banking and financial.

Reliability test was conducted for these statements. The cronbach alpha value was 0.838 as above .06 is acceptable (see Appendix I). The questionnaire also included the demographic information about respondents such as his/her Gender, Marital Status, Age group, Monthly income and qualifications.

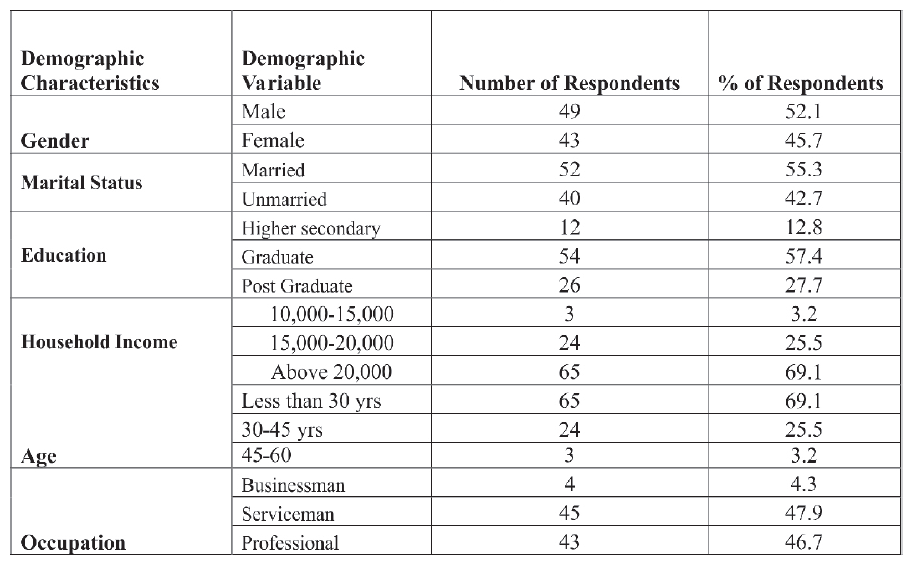

The demographic characteristics of the respondents are shown in below Table no. 1. The respondents profile gives detail information about financial and banking customer’s such as age, Gender, household income level, Education qualification, marital status and their occupation.

The analysis showed that the ratio of the male to female is 1.15:1. Whereas most of the respondents are married compromising the percentage of 55% whereas the unmarried % is 42.7%. The study targeted the young respondents having age less than 30 years followed by 30-45 years and then is post graduate and higher secondary. The majority of respondents had income above than 20,000. Majority of the respondents were professional and serviceman.

Table no. 1: Demographic Characteristics

Results of Factor Analysis

Reliability analysis has been conducted on 20 variables and Cronbach Alpha is determined as 0.838 which indicates reliability of the scale. Table 2 shows the reliability statistics.

Table 2: Reliability Statistics

| Reliability Statistics | |

| Cronbach's Alpha | N of Items |

| .838 | 20 |

Table 3: KMO and Bartlett's Test

| KMO and Bartlett's Test | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | .710 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 554.042 |

| Df | 190 | |

| Sig. | .000 | |

The analysis details of the factor analysis were presented in the above Table no. 3. As we can see the value of KMO was 0.710, which should lie between 0.5 and 1.0. Also, the statistical test for Bartlett test of sphericity was significant (p = 0.000; d.f. = 190) for all the correlations within a correlation matrix (at least for some of the constructs).

Based on the principal components analysis and VARIMAX procedure in orthogonal rotation,

Eigen values above 1.0 are selected. Discriminant validity indicated that all items were allocated according to the different constructs. Therefore, the items were not overlapping and they supported the respective constructs. The factor analysis reduced the data of 20 variables into the five factors which have the impact on the respondents. The summarized results are shown in table no 4.

Table No 4 : Summarized Results of Factor Analysis

| Sr.No | Factor-wise Dimensions | Eigen Value | % of variance explained | Cumulative % of variance explained | |

| 1. | Celebrity Endorsement | 2.800 | 14.000 | 14.000 | |

| I feel excited when I saw my favorite celebrity endorsing the Bank advertisements. | .768 | ||||

| Due to coming of my favorite celebrity in advertisement my trust on my Bank has increased. | .815 | ||||

| I believe the celebrities also use the same Bank for which they endorse | .687 | ||||

| I feel celebrity endorsement help in brand promotion of banks as well. | .552 | ||||

| 2. | Decision making | 2.481 | 12.403 | 26.404 | |

| Advertisement helps to be associated with the specific Bank. | .720 | ||||

| Quality Bank promote their products with the help of advertisement | .644 | ||||

| Publicity about my Bank influenced my decision for selecting this bank. | .529 | ||||

| 3 | Knowledgeable | 2.087 | 10.435 | 36.838 | |

| The advertisement and promotions of my Bank are knowledgeable. | .577 | ||||

| The content shown in the advertisement is easy to understand. | .787 | ||||

| Advertisement provides the information about the infrastructure, Customer services and other facilities of bank. | .681 | ||||

| 4 | Publicity effects | 2.028 | 10.142 | 46.981 | |

| The publicity about the Bank revealed some things I had not considered about this bank. | .539 | ||||

| I noted the message as shown in the advertisement act as guiding tool for my future decision. | .569 | ||||

| I purchase banking and investments products whenever new promotional offers are offered. | .740 | ||||

| 5 | Promotion About new schemes | 1.841 | 9.207 | 56.187 | |

| My bank advertises whenever new schemes are available. | .755 | ||||

| I feel positive toward the advertizing and promotions of my Bank. | .686 |

In order to determine the factor which is most important among the factors which has been extracted by the factor analysis we had applied the multiple regression analysis. The multiple regression analysis has been used to identify the impact of the advertisement on the buying behavior of the respondents.

In the table 5, R value represents the simple correlation and is .649 (the "R" Column), which indicates a high degree of correlation. The R2 value (the "R Square" column) indicates how much of the total variation in the dependent variable. In this case, 62.8 % can be explained, which is very large.

Table 5: Regression results between the Bank Selection parameters and the Advertisement

| Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | .805a | .649 | .628 | .47064 |

| Table 6 : ANOVA table for the Bank Selection parameters and the Advertisement | ||||||

| ANOVAb | ||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 1 | Regression | 35.158 | 5 | 7.032 | 31.745 | .000a |

| Residual | 19.049 | 86 | .222 | |||

| Total | 54.207 | 91 | ||||

Table 6 indicates the statistical significance of the regression model that was run. Here, p < 0.0005, which is less than 0.05, and indicates that, overall, the regression model statistically significantly predicts the outcome variable (i.e., it is a good fit for the data).

Table 7: T-value and p-value for the regression result between the Advertisement and the buying behavior

| Coefficientsa | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 3.772 | .049 | 76.869 | .000 | |

| REGR factor score 1 for analysis 1 | .172 | .049 | .223 | 3.487 | .001 | |

| REGR factor score 2 for analysis 1 | .556 | .049 | .720 | 11.268 | .000 | |

| REGR factor score 3 for analysis 1 | -.129 | .049 | -.168 | -2.625 | .010 | |

| REGR factor score 4 for analysis 1 | .077 | .049 | .100 | 1.564 | .122 | |

| REGR factor score 5 for analysis 1 | .158 | .049 | .205 | 3.202 | .002 | |

The Coefficients table 7 provides us with the necessary information to predict Impact of advertisement on bank selection or buying behavior of financial products, as well as determine which independent variable of bank selection parameter have major impact or is more important.

The table shows that factor 2 which is Decision making have the major impact on the people while they are watching advertisement since the sig value is less than .05 also the value of B is highest among all. Whereas the above table also predicts that factor 3 which is knowledgeable have the negative impact on the people while they are watching advertisements.

The regression equation for the above is:

Y= 3.772(constant) + .172( Celebrity Endorsement)X1 + .556(Decision making) X2 + (-.129) (Knowledgeable) X3 + .077 ( Publicity effects ) X4 + .158( Promotion About new products) X5

The present study we have performed an empirical investigation to find the major factors which will impact the customer’s decision making. The data been collected from India where the respondents were asked to tell the major factors that will affect the decision making.

The data analysis had found the five prompting factors that played a significant part in the buying process of the respondents. The research show that factors such as Celebrity Endorsement, Decision making, Knowledgeable, Publicity effects, Promotion About new schemes had major impact on the attitude, mind set and approach towards buying behavior. The customer paid a great attention to those financial players that will advertise their products; whenever new products come they inform the present customer about their services, and uses the latest method promotion so as to reach the maximum number of customers. As there is time of latest technology therefore those use latest technology such as mobile banking, e-banking, online statements, are most preferred by the customers. Whereas the further investigation states that the customers consider the advertisement in the decision making process as and when they purchase the banking and financial products.

The present research is useful to the banking and financial service providers as it identify the factors which play an important role in the attitude and decision making of the consumers.

But no research is free from limitations. Due to the scarcity of time and resources the data had not been collected from all around the country. Further the future research should be done in order to verify the pre and post behavior of the respondents after watching the different advertisements.

Carter, Tony. and Chattalas, Michael. (2001), “Marketing Financial Services in London”, Services Marketing Quarterly, Vol. No. 22, Issue No. 4, pp. no. 63-81.

Ryals, Lynette. and Payne, Adrian. (2001), “Customer relationship management in financial services: towards information-enabled relationship marketing”, Journal of Strategic Marketing, Vol. No. 9, Issue No. 1, pp. no. 3-27.

Gupta, A. K. and. Westal , G.( 1992-94),” Distribution Of Financial Services”, Transactions of the Faculty of Actuaries, Vol. 44 , pp. 24-63.

Ekerete, Pualinus P.(2005),” Marketing Of Financial Services: A Case Study Of Selected Merchant Banks In Nigeria”, Pakistan Economic and Social Review, Vol. No. 43, Issue No. 2 , pp. 271-287.

Sadeghi, Tooraj. and Bemani, Atefeh. (2011),” Assessing the Quality of Bank Services by Using the Gap Analysis Model”, Asian Journal of Business Management Studies,Vol No. 2, Issue No.1, pp. 14-23.

Hooman, Estelami., (2008) "Consumer use of the price-quality cue in financial services", Journal of Product & Brand Management, Vol. 17, Issue No. 3, pp.197 – 208.

Lindholm Oskari. (2008), “The influence of Sales Promotion on Consumer Behavior in financial services”, Helsinki School of management. Available at http://epub.lib.aalto.fi/en/ethesis/pdf/12006/hse_ethesis_12006.pdf [Retrieved as on 20th July 2012].

Bamoriya, Hemant. And Singh, Rajendra .( 2011),” Attitude towards Advertising and Information Seeking Behavior: A Structural Equation Modeling Approach”, European Journal of Business & Management, Vol.3, Issue No. 3,pp. 1-11.

Ekankumo, Banabo. and Henry , Koroye Braye .( 2011),” Sales Promotion Strategies of Financial Institutions in Bayelsa State” , Asian Journal of Business Management, Vol. No. 3, Issue No.3, pp. 203-209.

Dass, Rajanish. And Pal, Sujoy .(2011),” A Meta Analysis on Adoption of Mobile Financial Services”,Indian Institute of Management, Research and Publications, Working Paper No.2011-01-05.

Mylonopoulos, Nikolaos A. and Doukidis, Georgios I.( 2003), “Mobile Business: Technological Pluralism, Social Assimilation,and Growth” , International Journal of Electronic Commerce, Vol. 8, No. 1, pp. 5-22.

Beckett, Antony.,Hewer, Paul. And Howcroft, Barry. (2001),” An exposition of consumer behavior in the financial service industry”, International Journal of Bank Marketing,Vol. 18, No. 1,pp.15-26.

Sidhu, Dr. Muninder.(2003),”Impact of advertisements on the purchase behavior of urban home makers”.Journal of Management Studies, Vol. 3,pp. 105-112.

The Economic Times, August 31, (2010). Available at http://articles.economictimes.indiatimes.com /2010-08-31/news/27628037_1_education-sector-services-sector-print-ad. [Retrieved as on 22th July 2012].