|

Parul Akhter Assistant Professor School of Business Ahsanullah University of Science and Technology 141-142 Love Road, Tejgaon, Dhaka-1208, Bangladesh Contact No.:- +88 01817087978 E-mail:- Paru25.1980@gmail.com |

The microfinance institutions (MFIs) have provided financial services to the poor citizens and young entrepreneurs to achieve economic solvency. Microfinance institutions have faced competition and various obstacles for attaining sustainable profitability. This study concerns about key factors that are concerning the performance of microfinance institutions in Bangladesh. Self administer questionnaire (structured and Unstructured questionnaire) has been used based on a five point likert scale. It has selected top five microfinance institutions (Grameen Bank, BRAC, ASA, BURO Bangladesh and TMSS) as a sample. It has surveyed 170 employees who are working in these microfinance institutions in Dhaka city to collect the primary data. It has applied both descriptive statistics and inferential statistical methods to identify the key patterns that are shaping the performance of microfinance institutions. In this study, several hypotheses and conceptual framework have been developed on the base of background literature. It has applied reliability statistics, One-way ANOVA, and Multiple Regression Analysis to test hypotheses. The study finds that loan lending system, motivation of employee, proper management system, effective risk management technique and government regulatory framework have a significant relationship with microfinance institutions’ (MFIs) performance. It also represents that innovation and information technology (IT) has an insignificant relationship with the performance of microfinance institutions in Bangladesh. It shows that loan lending system, motivation of employee, proper management system, and government regulatory framework have a positive relationship of MFIs’ performance and effective risk management has a negative relationship with the performance of MFIs. It also found that the loan lending system is the most important issue to the performance of MFIs.

Keywords : Microfinance institutions (MFIs), loan lending system, Innovation and IT, motivation of employee, proper management system, effective risk management technique, government regulatory framework, and performance.

Microfinance sector is the largest and most efficient sector in the world. Microfinance institutions (MFIs) present credits facility to low-income people in many developing countries. Microfinance institutions are a development mediator for generating employment opportunities in a country (OECD, 1996; Morduch, 1999; and Zohir and Matin, 2004). Microfinance has been working for resource less and poor people with easy access financial services in Bangladesh. Micro finance institutions are building good environments in which it may flourish with self support (Adms, et al., 1983; and Buss, 1999).MFIs have introduced innovative incentive systems and also non-financial services. It has applied group-based lending techniques and main borrowers are women. It creates employment opportunities for women that increased repayment rates and economic sustainability (Hashemi, 1996; Godquin, 2004; and Weighton 2005).

The success of MFIs depends on their ability and social factors (Anderson et al., 2002). Most of the MFIs have sufficient numbers of professional staffs to perform their regular activities. They have monitoring systems to screen the clients’ projects (Schmidt, 1991; and Syukur et al., 1991).MFIs have well-trained and dedicated staff for running their activities. They have organized training program for new recruiting employees as well as existing employees. Employees are receiving training for carrying new position (Steinwand, 2001). Incentives are an extra influential managerial tool to inspire the public to achieve a specific goal. Staffs are influenced by the well planned motivation systems. MFIs depend on the effective financial risk management for sustaining profitability of the organization (Rusdy Hartungi, 2007).

In today’s microfinance institutions draw a great attention to academicians, researchers, policy makers, knowledge seekers, and development practitioners. MFIs create credit access to the general people of Bangladesh. MFIs are playing a vital role to achieve economic sustainability. Many researchers have presented the positive impacts on the social and financial perspective of microfinance. This study is going to focus on the different patterns that are influencing the performance of the MFIs, Bangladesh.

Through Microfinance institutions (MFIs) have been operating in Bangladesh since 1970. Microfinance institutions are expanding its activities to fulfill customer’s requirements. MFIs are launching new products and services according the customer’s needs. Bangladesh government established Palli Karma-Sahayak Foundation (PKSF) in 1990. The main vision of PKSF is to alleviate poverty with the creation of employment (Hasan and Ahmed, 2009).

The overall performance of microfinance institutions in Bangladesh at a glance (Table 1) is given below. It shows the name of top five microfinance institutions, no. of branches, active members, loan disbursement, loan outstanding and no. of outstanding borrowers till 2015 in Bangladesh.

Table 1: Microfinance Operations in Bangladesh

|

Name of the Organization |

Number of Branches |

Number of Active Members |

Loan Disbursed (Tk. In million) |

Loan Outstanding (Tk. In million) |

Numbers of Outstanding Borrowers |

|

Grameen Bank |

2568 |

880,6779 |

149,227.30 |

96,422.30 |

6,856,448 |

|

ASA |

2932 |

690,2024 |

17,6831.73 |

109,652.86 |

5,898,466 |

|

BRAC |

2083 |

537,7951 |

192,982.79 |

113,106.44 |

5,298,651 |

|

BURO Bangladesh |

804 |

130,5378 |

32,397.25 |

23,256.42 |

873,500 |

|

TMSS |

622 |

842,401 |

24,840.01 |

15,641.42 |

717,819 |

Source: Credit and Development Forum Statistics, 2015.

(http://www.cdfbd.org/new/page.php?scat_id=154, 06/06/2017)

The Grameen Bank is the leader of microfinance institutions in Bangladesh. It has 2568 branches while the no. of active members is 880, 6779. The Grameen Bank has been performing very well and having BDT 149,227,30 million loan disbursement, loan outstanding is BDT 96,422.30 million and 6,856,448 no. of outstanding borrowers.ASA is another popular MFI in Bangladeshwith2932branches and 690, 2024 no. of active members. The total loan disbursement of ASA for the year 2015 is BDT 17, 6831.73 million. ASA has BDT 109,652.86 million total loans outstanding and 5,898,466 no. of outstanding borrowers. BRAC is another most popular microfinance institution. The total no. of branches is 2083 and no. of active members is 537, 7951. BRAC has BDT 192,982.79 million loan disbursement and BDT 113,106.44 million loan outstanding. The total no. of outstanding borrowers is 5,298,651.BURO Bangladesh is one of the well known microfinance institution. It has 804 branches and 130, 5378 no. of active members. The total loan disbursement is BDT 32,397.25 million, while total outstanding loan BDT 23,256.42 million and outstanding borrowers is 873,500. TMSS is working in this sector and their total branch is 622. The total no. of active members is 842,401 and loan disbursement amount is BDT 24, 8440.01 million. TMSS has BDT 15,641.42 million loans outstanding while total outstanding borrowers is 717,819.

Table 2: Trends and Growth of Microfinance Program in Bangladesh

|

Year 2011 |

Year 2015 |

Growth in 2015 over 2011 (%) |

|||||

|

Indicator |

MFIs Reported |

No. |

Per MFI |

MFIs Reported |

No. |

Per MFI |

|

|

Employment Generation (in No.) |

695 |

231,098 |

333 |

506 |

233,503 |

461 |

38.58 |

|

Members (in No.) |

695 |

33,062,340 |

47,572 |

506 |

36,232,279 |

71,605 |

50.52 |

|

Borrowers (in No.) |

695 |

33,062.340 |

39,097 |

506 |

36,232,279 |

58,486 |

49.59 |

|

Members Net Savings (BDT in million) |

695 |

186,152 |

268 |

506 |

270,690 |

535 |

99.61 |

|

Loan Disbursement (BDT in million) |

695 |

440,288,84 |

633,51 |

506 |

827,768,40 |

1,635,91 |

158.23 |

|

Outstanding Loan (BDT in million) |

695 |

279,815,51 |

402,61 |

506 |

521,829.36 |

1,031.28 |

156.15 |

Source: Author’s Own Calculation Based on CDF Statistics 2015 (BDT = Bangladeshi Taka)

Table 2 shows the overall scenario of microfinance institution’s performance (2011 and 2015) in Bangladesh. This study is considered different indicators to focus on the trends and growth of MFIs. Employment generation per MFI has increased by 38.58% over a period of five years since 2011. The data shows that the growth of members per MFIs is 50.52% in 2015 compared with 2011. The borrower per MFIs has increased by 49.59% in 2015. The table presents that the growth of members of net savings per MFIs is 99.61% in 2015 which is considered as double growth compared with 2011. The data shows that the growth of loan disbursement and outstanding loan per MFIs respectively is 158.23% and 156.15% over a period of five year since 2011.

The literature has shown the success of microfinance institutions depend on various factors such as management, leadership, staff training, motivation of employees, information technology, innovation of products or services, loan lending system, government regulatory framework, financial risk management, marketing, corporate governance and auditing system (Mamun, 2012;Woller and Woodworth, 2001; Crabb, 2008; Irene and Albert, 2013; Leonard and Julius, 2016; Chowdhury, 2009; Hulme and Moore, 2006; Chan, 2010; Boating and Agyei, 2013; Ledgerwood and White, 2006; Hassan, 2002).

1. Loan Lending System

The progress of microfinance institutions requires loan lending systems. MFIs are introduced collateral free and group lending systems. Collateral free lending systems are creating an opportunity for the poor people to receive credit facility from the MFIs. Group lending systems are another instrument to recover the loan amount. Microfinance institutions are providing a unique loan system that provides financial support to the poor people in the country; these are also providing support for the growth of MFIs (Mamun, 2012; Irene and Albert, 2013; Hassan, 2002).

H1: There is a significant relationship between loan lending system and MFIs performance.

2. Innovation and Information Technology (IT)

Innovation of products or services and information technology systems has significant impacts on the performance of MFIs (Leonard and Julius, 2016; Irene and Albert, 2013; Chowdhury, 2009; Hassan, 2002). MFIs are continuous providing new products or services to fulfill customers demand. They are serving different types of loan, such as agriculture loan, education loan, entrepreneur’s loan, SME loan, and many other voluntary activities. Information technology is helping the MFIs to record all types of information about the clients as well as maintaining regular activities.

H2: There is a significant relationship between innovation and information technology and MFIs performance.

3. Motivation of Employee

The success of the institution depends on skilled employees and it drives on motivational instruments such as training and refresher training of employees, employee incentive systems, and promotion and bonus systems. These all factors are fostering the growth of MFIs. Staff training is the primary items to enhance the skill of employees in any institutions and it has a direct relation to the progress of the microfinance sector (Chowdhury, 2009; Mamun, 2012; Leonard and Julius, 2016).

Performance based incentive has a significant relationship with the growth of MFIs (Hulme and Moore, 2006; Hartungi, 2007). Promotion and bonus systems are the most common technique to motivate the employees and these have also influenced the success of MFIs (Kaplan and Norton, 2009; Chowdhury, 2009).

H3: There is a significant relationship between motivation of employee and performance of MFIs.

4. Proper Management System

Management is the pillar stone for any institution to become success and the sustainability of an organization depends on it. Management is necessary for establishment of organizational structure as well as leadership is an effective technique to achieve the MFIs’ goal (Leonard and Julius, 2016; Chan, 2010). Proper management creates a comfortable environment for the employees to become highly committed, highly focused and accountability and it enhances innovation and growth of MFIs (Ledgerwood and White, 2006).

H4: There is a significant relationship between Proper management and MFIs performance.

5. Effective Risk Management Technique

Effective risk identification techniques, risk measurement, monitoring and management initiatives is essential for each and every MFIs (Leonard and Julius, 2016; Bounoula and Rihance, 2014; Irene and Albert, 2013; Kimando and Kihori, 2012). Effective risk management has an important role to screen and select of the loan clients; it is also required to reduce loan default rate (Pinz and Helming, 2014).

H5: There is a significant relationship between effective risk management technique and performance of MFIs.

6. Government Regulatory Framework

Literatures show that the growth of microfinance institution performance depends on rules and regulations of the government because effective regulatory structure creates a suitable environment for MFIs (Woller and Woodworth, 2001; Crabb, 2008).Institutional and country regulation is an important factor in the achievement of microfinance institutions. Regulatory framework provides a supportive environment for the development of MFIs (Boating and Agyei, 2013).

H6: There is a significant relationship between regulatory framework and MFIs performance.

The general objective of this study is to focus on the determinant aspects causing the progress of microfinance institutions in Bangladesh. The specific objectives of this study are:

§ To identify whether innovation IT has a significant relationship to MFIs performance.

§ To examine whether loan lending system has a significant relationship with the performance of MFIs.

§ To show whether the motivation of employee has a significant relationship to the performance of MFIs.

§ To surface whether the effective risk management technique has a significant relationship to MFIs performance.

§ To examine whether a proper management system has a significant relationship with the performance of MFIs.

§ To see whether the government regulatory framework has significant relationship to the performance of MFIs.

Many studies have concerned about the challenges of microfinance institutions (MFIs) in the world (Fatimah-Salwa, A.H., Mohamad-Azahari, A. &Joni-Tamkin, A., 2013) and main success aspects of the promising markets of Asia, little has been focused on key factors that force the achievement of microfinance institutions in Bangladesh (Mokhtar, S.H., Nartea, G. &Gan, C., 2012; Chan, S.H., 2010; Chowdhury, A.M., 2009).This study tries to seek out the key factors that drive the performance of microfinance institutions in Bangladesh so that this sector can leverage on the factors to foster growth as well as make sure financial sustainability in Bangladesh.

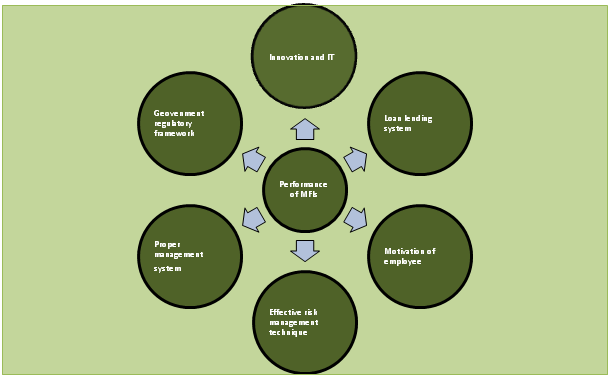

Loan lending system, innovation and IT, motivation of employee, proper management system, effective risk management technique, and government regulatory framework are perhaps the usually used variables in the field of relationship management. A conceptual research model has been developed based on the above review of literature to analyze the relationship among all these variables with MFIs performance.

Figure 1: Conceptual Framework

Source: Researcher Own Point of View

1. Sampling Design

The target population is the microfinance institutions (MFIs) in Bangladesh. The sample is taken from the Dhaka city’s microfinance institutions (MFIs).Purposive sampling method will be used for selecting the MFIs because it is an effective technique for selecting sample. The researcher has selected top five microfinance institutions (Grameen Bank, BRAC, ASA, BURO Bangladesh, and TMSS) in Dhaka city, the capital city of Bangladesh.

2. Methods of Data Collection

The study has used both primary and secondary data. Secondary sources of data are gathered by international journals, books, etc. Primary data were collected through questionnaire survey method and using “Likert Scale”. Considering the nature of the study structured questionnaire designed with a 5 point Likert scale (Strongly disagree=1, Disagree=2, Neutral=3, Agree=4 and Strongly agree=5).The researcher has decided to survey one hundred seventy (170) individual manager/ assistant managers/ field officers from different MFIs in Bangladesh.

3. Research Tools

In this study, both descriptive statistics and inferential analysis methods (multiple regression analysis) from the Statistical Package of the Social Science (SPSS), version 16.00 has been used. This paper applies reliability statistics and multiple regression analysis to prove the hypothesis for determining key dimensions affecting the success of microfinance institutions in Bangladesh.

The relationship between performance of MFIs (S, representing MFIs success), as a dependent variable, and loan lending system (LLS), innovation and IT (IIT), motivation of employee (ME), proper management system (PMS), effective risk management technique (ERMT), government regulatory framework (GRF) as independent variables. The level of significance is 5% and the error term is e. The model is as follows:

4. Limitation and Scope of the Study

This study has some limitations, these are as follows:

§ The data has been gathered through a purposive sampling method that guides to the subject of simplification.

§ The sample frame is limited because it was considered of Dhaka city; if these data have been collected from different cities it would have changed the outcome.

1. Reliability of Data

The reliability of a measure presents the level of internal consistency and free from random error (Zikmund, et al., 2007).Cronbach’s coefficient alpha is the overall scale measuring device. The value of Cronbach’s alpha is between 0 to 1. The value of 1 indicates perfect internal consistency and the value of 0 presents the no internal reliability (Pallant, et al., 2005). The value of

Table 3: Reliability Statistics

|

Cronbach's Alpha |

No of Items |

|

.914 |

7 |

Cronbach’s coefficient alpha is .914 which represents a high level of internal reliability among 7 variables. The result of internal consistency ensures a ground for further study and analysis.

Table 4: Demographic Outline of the Respondents

|

Variables |

Respondents No.=170 |

Frequency (%) |

|

Name of MFIs |

||

|

Grameen Bank BRAC ASA BURO Bangladesh TMSS |

45 40 40 25 20 |

26% 24% 24% 15% 11% |

|

Gender |

||

|

Male Female |

99 71 |

58% 42% |

|

Age (Years) |

||

|

26-30 |

41 |

24% |

|

31-40 |

45 |

26% |

|

41-45 |

54 |

32% |

|

Above 45 |

30 |

18% |

|

Income Level (Monthly) |

||

|

Below 20000 BDT |

21 |

12% |

|

21000-300000 BDT |

30 |

18% |

|

31000-40000BDT |

39 |

23% |

|

41000-50000BDT |

51 |

30% |

|

Above 50000 BDT |

29 |

17% |

|

Education Level |

||

|

HSC |

55 |

32% |

|

Graduation |

65 |

38% |

|

Post-graduation |

50 |

30% |

Source: Survey Data

The above table shows the demographic profile of the respondents. The respondents are operating the microfinance institutions in Bangladesh. The demographic factors are included name of the microfinance institutions, gender, age, income level and educational level. From this study, it has been found that 26% of the respondents are working in Grameen Bank while 11% of the respondents are working in the TMSS. In the case of gender, male respondents are 58% and female respondents are 42%. It is shown that those age groups 31 to 40 are responds at 32% and age group above 45 are responds only 18%. The respondents’ monthly incomes 41000 to 50000 taka are 30% and above 50000 taka are 17 % only. Final statistics show that the respondents have graduation (38%) and post-graduation 30 % only.

2. Multiple Regression Analysis

|

Table 5: Model Summary |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.815a |

.665 |

.652 |

.53047 |

|

a. Predictors: (Constant), Government Regulatory Framework, Loan Lending System, Proper Management System, Motivation of Employee, Effective Risk Management Technique, Innovation and IT |

||||

In this study, multiple regression analysis has been used to find out the determinants of successful criteria in microfinance institutions in Bangladesh. Table 5 shows the model summary of multiple regression analysis. In model summary the R value is .815, which indicating the correlation of six (6) independent variables with the dependent variable. The value of the coefficient of multi determination is R Square=.665, this means 66.5percent variation in the dependent variable, i.e. performance of microfinance institutions are defined by independent variables that are innovation and IT, loan lending system, motivation of employee, proper management system, effective risk management technique, government regulatory framework and remaining 33.5 percent can be explained by other attributes which are not studied in this paper.

|

Table 6: ANOVAa |

||||||

|

Model |

Sum of Squares |

Df |

Mean Square |

F |

Sig. |

|

|

1 |

Regression |

90.932 |

6 |

15.155 |

53.857 |

.000b |

|

Residual |

45.868 |

163 |

.281 |

|||

|

Total |

136.800 |

169 |

||||

|

a. Dependent Variable: Profitability of MFIs |

||||||

|

b. Predictors: (Constant), Government Regulatory Framework, Loan Lending System, Proper Management System, Motivation of Employee, Effective Risk Management Technique, Innovation and IT |

||||||

In table 6 shows that the ANOVA test result (F=53.857, P=.000) represents the fitness of the model. It can be concluded that the combination of the independent variables significantly predicts patterns of performance of MFIs in Bangladesh.

3. Hypothesis Testing

|

Table 7: Coefficientsa |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

T |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1. (Constant) |

.180 |

.214 |

.840 |

.402 |

||

|

Loan Lending System |

.520 |

.072 |

.502 |

7.240 |

.000 |

|

|

Innovation and IT |

.071 |

.072 |

.067 |

.986 |

.326 |

|

|

Motivation of Employee |

.239 |

.078 |

.224 |

3.074 |

.002 |

|

|

Proper Management System |

.165 |

.074 |

.154 |

2.233 |

.027 |

|

|

Effective Risk Management Technique |

-.196 |

.080 |

-.176 |

-2.441 |

.016 |

|

|

Government Regulatory Framework |

.162 |

.067 |

.150 |

2.414 |

.017 |

|

|

a. Dependent Variable: Performance of MFIs |

||||||

Table 7 shows the influential strength of each of the independent variables to the dependent variable. The hypotheses of this study are connected with the organisational impact of six (6) variables on the Performance of MFIs in Bangladesh. The test of these hypotheses guides to reach the object of this study.

Testing H1

In table 7, the result presents that there is a significant relationship between loan lending system and Performance of microfinance institutions with (Beta=.502) and (p=.000<.05). This means that the loan lending system is most significant determinants contributing more than 50 percent of Performance of MFIs. The result of the study accepts H1. The loan lending system is influencing the Performance of MFIs.

Testing H2

From table 7, the result shows that there is an insignificant positive relationship between innovation and IT and Performance of MFIs with (Beta=.067) and (p=.326> .05). These results of the study reject H2. It means that innovation and information technology (IT) has no significant relationship with the Performance of MFIs. The study found that innovation and information technology is not directly influence the Performance of MFIs.

Testing H3

From table 7, the result is shown that there is a significant relationship between motivation of employee and Performance of MFIs with (Beta=.224) and (p=.002<.05). The result of this study supports H3. This means that motivation of employee influences more than 22 percent Performance of MFIs in Bangladesh. The performance of microfinance institutions depend on the motivation of employees. It is very essential key factor for all types of organization for attaining their target.

Testing H4

In table 7, it is presented that there is a significant relationship between the proper management system and Performance of MFIs with (Beta=.154) and (p=.027<.05).This means that the proper management system influences more than 15 percent of Performance of MFIs. The results of this study accept the H4. The management system is the most important factor for any institution. The proper management system helps the organization to attain the success in the future.

Testing H5

From table 7, it shows that there a significant negative relationship between effective risk management technique and Performance of MFIs with (Beta=-.176) and (p=.016<.05). The result of the study supports the H5. The data indicate that negative relationship between effective risk management and MFIs Performance. Sometimes risk management technique reduces MFIs profitability and influences the performance.

Testing H6

In table 7, the result shows that there is a significant relationship between the government regulatory framework and performance of MFIs with (Beta=.150) and (p=.017<.05). This means that government regulatory framework has been influenced of 15 percent performance of MFIs. The results of the study accept H6. The data indicate that government regulatory framework is an essential influential key factor for achieving the performance of MFIs.

The objective of this study was known about key factors that are affecting the performance of microfinance institutions in Bangladesh. Multiple regression analysis is used in this study to find out potential factors that lead performance of MFIs. Based on prior literature, six prominent factors were identified. The results of the study show five factors, i.e. loan lending system, motivation of employee, proper management system, effective risk management technique, government regulatory framework significantly influencing the performance of microfinance institutions.Innovation and IT has an insignificant relationship with MFIs performance.The four factors have positive relations to the performance of MFIs in Bangladesh namely government regulatory framework, loan lending system, proper management system, and motivation of employee. The effective risk management technique has a negative relationship with performance of MFIs. On the other hand, highest impact factor is loan lending system of the microfinance institutions and it contributes performance of MFIs in Bangladesh.

Bangladesh is a developing country. Microfinance institutions are world recognized organizations to alleviate the poverty that has been operated to aid the poor of the country (Meisami, et al., 2011; Fernando, N. 2008). Nowadays, microfinance institutions are becoming a significant investment prospect in many countries. This study would be helped the academician, researchers, managers, and rule makers to develop their expertise about the key factors of microfinance institution’s performance.

1. Abdi, H., and Williams, L.J. (2010). Principal Component Analysis. Wiley Interdisciplinary Reviews, Computational Statistics, 2:433-459.

2. Adams D.W., Graham D.H., Von Pischke J.D. (Ed.), (1983). Limitations of Cheap Credit in Promoting Rural Development. Washinton, D.C., World Bank, EDI Training Materials.

3. Al Mamun, C.A. (2012). Assessing the factors that led to the success of microfinance in Bangladesh: A case study on Grameen Bank. World Review of Business Research, 1-14.

4. Anderson, L., Locker, L., and Nugent R. (2002). Microcredit , Social Capital, and Common Pool Resources. World Development, 30(1), 95-106.

5. Boateng, I.A&Agyei, A. (2013). Microfinance in Ghana: Development, Success Factors and Challenges. International Journal of Academic Research in Accounting, Finance and Management Sciences, 3(4), 153–160.

6. Bounouala, R. & Rihane, C. (2014). Commercial Banks in Microfinance: Entry Strategies and Keys of Success. Investment Management and Financial Innovations, 11(1).

7. Buss Terry F. (1999). Microenterprise in International Perspective: An Overview of the Issues. International Journal of Economic Development, 1(1), 1-28.

8. Chan, S.H. (2010). The influence of leadership and experience on organizational performance: a study of Amanah Ikhtiar Malaysia. Asia Pacific Business Review, 16, 59-77.

9. Chowdhury, A.M. (2009). Assessing the Factors That Led to The Success of Microfinance in Bangladesh: A Case Study on Grameen Bank.

10. Crabb, P. (2008). Economic Freedom and the Success of Microfinance Institutions. Journal of Developmental Entrepreneurship, 13(2), 205–219.

11. Fatimah-Salwa, A.H., Mohamad-Azahari, A. &Joni-Tamkin,A. (2013).Success Factors of Successful Microcredit Entrepreneurs: Empirical Evidence from Malaysia. International Journal of Business and Social Science, 4(5), 153-159.

12. Fernando, N. (2008). Managing microfinance risks: some observations and suggestions.Asian Journal of Agriculture and Development, 4(2):1-22.

13. Godquin, M. (2004). Microcredit Repayment and Performance in Bangladesh: How to Improve on Allocation of Loans from MFIs. World Development32 (11).

14. Hassan, T., &Ahmed, S. (2009). Microfinance Institutions in Bangladesh: Achievements and Challenges. Managerial Finance, 35(12), 999-1010.

15. Hashemi, S., S. Schuler, and I. Riley (1996). Rural Credit Programs and Women’s Empowerment in Bangladesh.World Development 24(4).

16. Hassan, M.K. (2002). The Micro Finance Revolution and the Grameen Bank Experience in Bangladesh,’ Financial Markets Institutions & Instruments, Vol.11, No.3, pp.205-65.

17. Hartungi, R. (2007). Understanding the Success Factors of Micro-finance Institution in a Developing Country. International journal of Economics, 34 (6), 388-401.

18. Hulme, D. & Moore, K. (2006). Why Has Microfinance Been a Policy Success in Bangladesh (and Beyond)? Global Poverty Research Group. Retrieved from http://www.gprg.org/

19. Irene Akuamoah Boateng and Albert AGYEI, (2013). Microfinance in Ghana: Development, Success Factors and Challenges. International Journal of Academic Research in Account, Finance and Management Sciences, 3:4 (153-160).

20. Kaiser, H. F. and Cerny, B.A (1970). Factor Analysis of the Image Correlation Matrix. Educational and Psychological Measurement, 39:711-714.

21. Kimando, L.N., Kihoro, J.M & Njogu, G.W. (2012) Factors Influencing the Sustainability of Micro-Finance Institutions in Murang’a Municipality. International Journal of Business and Commerce, 1(10), 21-45.

22. Ledgerwood, J. & White, V. (2006). Transforming Microfinance Institutions: Providing Full Financial services to The Poor. The World Bank, Washington.

23. Leonard Mbira and Julius Tapera, (2016).Key Success Drivers for Microfinance Institutions in Zimbabwe: Developing Core Competences for Financial Inclusion. International Journal of Business and Social Science, 7: 3 (128-135).

24. Meisami, Manzur and Roayaee, (2011).Islamic vs. Conventional Microfinance: A Comparative Theoretical Analysis. International Journal of Business and Management Tomorrow, Vol. 1 No. 1

25. Mokhtar, S.H., Nartea,G. &Gan, C. (2012). The Malaysian microfinance system and a comparison with the Grameen Bank (Bangladesh) and Bank Perkreditan Rakyat (BPR-Indonesia).The Arts Journal, 1(3), 60-71.

26. Morduch Jonathan. (1999a), The Microfinance Promise, Journal of Economic Literature, 37, 1569-1614.

27. OECD, (1996). Microcredit in Transitional Economics,. Paris: Territorial Development Service, Organization for Economic Co-operation and development, OCED/GD (96)40.

28. JohirSajjad, and Imran matin (2004)Wider Impacts of Microfinance Institutions: Issues and concepts, Journal of International Development, 16, 301-330.

29. Pallant, Julie (2005). SPSS SURVIVAL MANUAL A step by step guide to data analysis using SPSS for Windows (Version 12). Vol.12. n. k.ed., Crows Net NSW 2065 Australia, Allen &Unwin. N. k., n. k.

30. Rusdy Hartungi, (2007), Understand the Success Factors of Microfinance Institution in a Developing Country, International Journal of Social Economics, 6-10.

31. Schmidt L. T. (1991), Rural Credit between Subsidy and Market. Adjustment of the Village Units of BRI in Sociological Perspective. Leiden Development Studies, p. 343.

32. Syukur M., P. Suharto, Y. M. Colter. (1991), KUM: The Grameen Bank Approach to Poverty Alleviation in Indonesia. Bogor, Centre for Agro-Economic Research, p.35.

33. Weighton, L (2005). Developing Ghana by Empowering Women. Global News Wire: Ghanaian Chronicle.

34. Woller, G. & Woodworth, W. (2001). Microcredit as a grass-roots policy for international development. Policy Studies Journal, 29(1), 267–283.

35. http://www.cdfbd.org/new/page.php?scat_id=160, 05.06.2017

36. http://www.mra.gov.bd/images/Licensed_NGO_MFIs/lic160517en.pdf, 05.06.2017

37. Zikmund, W. G, Babin,B.J.,Carr,J.C., Adhikari.A., & Griffin,M. (2007). Business Research Method: South Asian Perspective, (8th ed.). Cengage Learing India Pvt. Ltd.