|

Dr. ShilpaLodha Assistant Professor Department of Accountancy and Statistics Mohanlal Sukhadia University, Udaipur (Raj) |

Mr. Azhar Ahmed Sheikh Senior Research Fellow Department of Accountancy and Statistics Mohanlal Sukhadia University, Udaipur (Raj) |

The environment in which the accounting profession functions is constantly changing. The ability of the accounting profession to effectively and continuously meet new challenges confronting it and to adapt its services to changing conditions and circumstances is directly associated with the soundness of its educational foundation. It has been evidenced from various researches that there is a gap between the accounting education and its practices. Universities can play a vital role in mitigating this gap by providing demand based accounting education to the future accountants, so that they can serve the purpose of the industry. It was felt that a gap exists between accounting theory and its practices. Therefore a research question was raised to analyze the perceived gap between academicians and PG Students about Accounting Education System in India.

For that purpose a purposive sample consisting of M.Com. Accountancy Students and Academicians, teaching accounting subjects and working at various institutions at Udaipur district were chosen and were given a structured questionnaire. Apart from the opinion on present contents of accounting curriculum and teaching pedagogies, respondents were also offered to show their agreement or disagreement on 4-point Likert-scale regarding contents to be included in accounting curriculum, basic skills & technological skills required for an accounting professional and teaching aids & methods required for teaching accounting subjects efficiently. Proven the non-normality of the data, various non-parametric tests i.e. K-S One Sample Test, Mann Whitney U Test were applied to test the significance of difference from the neutral opinion and significance of difference between the opinion of the academician and students opinions. Findings reveal that there is a huge gap between the perception of academicians and students about accounting education system in India. Results show that students are keener to learn new and cotemporary subjects, use of newer skills, use of latest teaching aids and methods etc. as compared to academicians.

Keywords: Academicians, Students, Accounting Education System, Mann-Whitney U Test

Higher education should ensure that there is transfer of knowledge a good learning environment (Vroeijenstijn 1995). When these are present, higher education can create graduates with the conceptual knowledge and critical thinking necessary for the workforce, including being an accountant. The environment in which the accounting profession functions is constantly changing. The ability of the accounting profession to effectively and continuously meet new challenges confronting it and to adapt its services to changing conditions and circumstances is directly associated with the soundness of its educational foundation. Such ability becomes even more important in a country with a developing economy, where the need for accounting services is the most acute. One of the profession’s responsibilities is to ensure the quality of the academic education or prequalification training of its future members to enable them to perform competently as accountants. Like other learned professions, such as medicine and law, the accounting profession depends on the academe as a source of its man-power. The profession adequately needs trained new accountants who will be able to cope with the requirements of professional work. Unfortunately, accounting education in tertiary education is perceived as being problematic with concerns over course content and curriculum, pedagogy, skill development, the use of technology, faculty development and reward structure (Albrechtand Sack 2000). Albrecht and Sack further argue that curricula designed is too narrow and often not updated, driven by the interests of faculty not the market demand. The pedagogy lacks creativity which impedes students’ ability to learn. Several studies suggest that accounting education is in crisis with a gap between accounting education and accounting in practice (Turner et al. 2011, Albrecht and Sack 2000, Wally-Dima 2011, Watty 2005). Wally-Dima (2011) suggests that the accounting education of universities puts more emphasis on teaching students for qualification examinations rather than advancing students’ professional skills. She further argues that the graduates produced by universities are ill-equipped to handle the needs of the accounting profession. Therefore, this study aims to empirically analyze the perceived gap between academician and PG accounting students about the present accounting education system in India. In particular, this study attempts to discern the significance of difference between the perception of academicians and students about the present accounting curriculum, contents & subjects should be included in curriculum and skills & technological skills an accountant should possess. This paper is outlined as follows: the next section discusses the literature review; followed by the research methodology. The empirical analysis and results have been discussed in section 4; and the last section contains the conclusion of the study.

Accounting has become a key discipline because it functions as ‘the language of business’ (Burritt and Tingey-Holyoak 2011). It is a responsibility of every accounting academician that they should develop such accounting professionals which can serve the purpose of every business organization and industry. Considering the importance of accounting,accounting education delivered in higher education should be in accordance with accounting in practice. Unfortunately, the bond between accounting education and accounting in practice has been heavily criticized (Burritt and Tingey-Holyoak 2011). Though several studies have been made on the higher education system and accounting education system worldwide but few relevant literature are as follows: Curricula of School of Accountancy are relevant to the accounting profession; however few contents and subjects need to be revisited to accord with current business practices (Suryawathy & Putra, 2014). The study was aimed at to discover the extent to which the accounting curriculum meets the needs of accounting professionin Balinese context. A gap exists between the perception of accounting education in the classroom and accounting as it is practiced (Johnson, 2014), research also explored the ways in which faculty members can positively impact practitioners.Designing a syllabus must be continuous,dynamic and interacting with professional societies andbusiness so that it causes continual improvements and higher expectations (Mashayekhi & Mohammadi, 2014).The adjustment of education mode aims to drive students to learn actively in order to achieve the goal of accounting education mode reformation (Yuan & Lou, 2015). There is at a least a gap between accounting research and practice (Grosu et al, 2015). University education plays a vital role in narrowing the existing gap between the academia and practice. A combination of intellectual, personal attributes and future competencies is needed by all accounting graduates to be included in the curriculum (Paino & Puteh, 2006). Findings of earlier researches put a question mark on the present accounting education system and contents of curriculum. Therefore a research question is raised to explore the perceived gap between the academician and accounting students towards the present accounting education system. Many studies have been conducted on this topic worldwide but there is a lack of research evidences on this topic in India. So this study is an attempt to empirically analyse the perceived gap between academician and PG students from accounting fraternity about the present accounting education system in India.

3.1. Objectives • To find out the perceptions of accounting students as well as academicians regarding utility of accounting syllabus, subjects, required skills in future accountants and teaching aids to beused while teaching accounting subjects. • To find out whether perceptions of accounting students and academicians differ significantly. 3.2. Hypotheses • H01: The perceptions of accounting students as well as academicians do not differ significantly for the present contents of accounting curriculum and teaching pedagogy. • H02: The perceptions of accounting students as well as academicians do not differ significantly for the subjects to be included in accounting curriculum. • H03:The perceptions of accounting students as well as academicians do not differ significantly for required skills in accounting professionals. • H04:The perceptions of accounting students as well as academicians do not differ significantly for required technological skills in accounting professionals. • H05:The perceptions of accounting students as well as academicians do not differ significantly for various teaching aids required for teaching accounting subjects. • H06:The perceptions of accounting students as well as academicians do not differ significantly for various teaching methods for teaching accounting subjects.

For the purpose of study both secondary and primary data have been collected. The secondary data has been collected from Research data bases like JSTOR and Science Direct, Journals, Books, Online search engines like Google Scholar, unpublished and published dissertations, magazines and newspapers. The primary data was collected by convenient purposive sampling. The universe of the study was Accounting PG students and Accounting Academicians.Two separate questionnaires were prepared containing various statement and questions. In both the questionnaires, section one was related with basic demographic information. Section 2 contained statements measuring utility of accounting in practical life, towards which respondents had to state their agreement on a 4-point Likert scale ranging from Strongly Disagree (1) to Strongly agree (4). Section 3 had options for 32 accounting subjects, where respondents has=d to state their necessity on 4-point Likert scale. Section 4 and 5 were related to the basic and technological details required for future accounting professionals where respondents had to mention their requirements on. Section 6 dealt with various teaching aids and respondents had to mention their importance and the last section contained various teaching methods and respondents had to mention their necessity. All the sections were based on 4-point Likert scale. In case of academicians 50 questionnaires were distributed but only 33 responses could be collected. In case of students, 150 questionnaires were distributed and 126 responses were received. Among them 29 responses for academicians and 109 responses for students were found to be fit for research purpose..

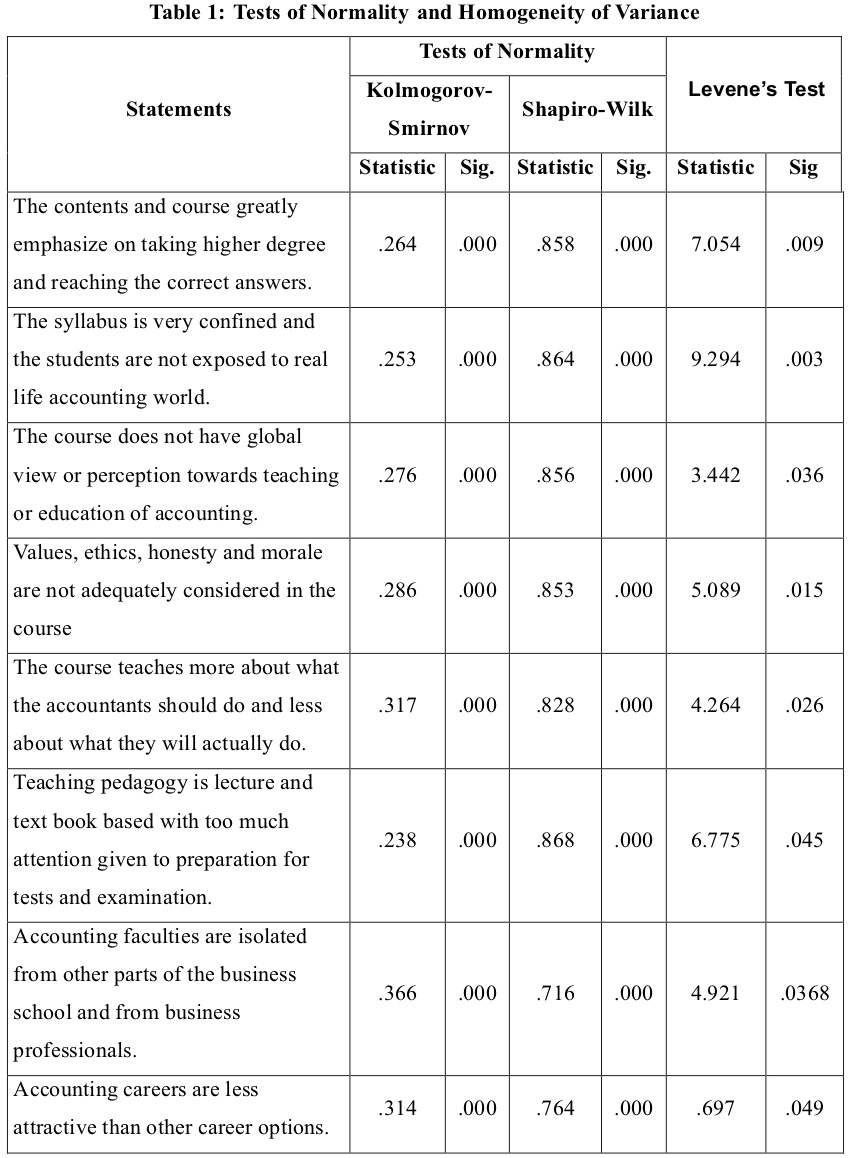

The assumption of homogeneity of variance has been tested using Levene's Test of Equality of Variances, which provides an F-statistic and a significance value (p-value). We are primarily concerned with the significance value; if it is greater than 0.05 (i.e., p > .05), our group variances can be treated as equal. However, if p < 0.05, we have unequal variances and we have violated the assumption of homogeneity of variances.

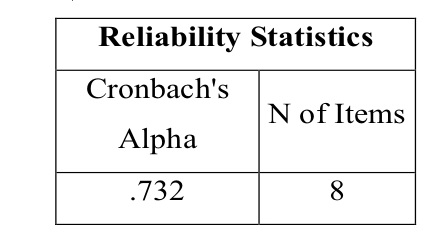

At the outset, the reliability of the instrument was checked through Cronbach’s Alpha test. Internal consistency or reliability defines the consistency of the results delivered in a test, ensuring that various items under assessment of conflict management issues are measured correctly and reliably by respondents on Likert scale. This is checked statistically through Cronbach’s coefficient Alpha (α). An Alpha value which is greater than 0.70, is considered to be reliable.

The calculated value of Cronbach’s Alpha comes to 0.732, which satisfy the reliability consideration. Before deciding on whether to use parametric or non-parametric test, it is necessary to check for the assumptions of parametric test. The first and foremost assumption of parametric test is of normality of the data. Table 1 presents the results of normality test and test of homogeneity of variance in the independent variable.

For the purpose of study, the data set was split in two groups, on the basis of category of respondents. The significance level or alpha value is set at 0.05. The independent, categorical variable (Category) has two levels/groups, Academicians and PG Students.Continuous dependent variables are the eight statements relating to utility of accounting in practical life. Table 1 reveals that both Kolmogorov-Smirnov Test and Shapiro-Wilk Test of normality have significant p-value indicating the rejection of null hypothesis of normality. Levene’s test of homogeneity of variance has significant p-value for all statements. Thus the null hypotheses of equality of variance of both the groups also get rejected. Hence the choice remains with non-parametric tests. As the normality assumption is violated we run the Kolmogorov-Smirnov test as substitute for Z-test and Mann-Whitney U test for two sample test. Both are non-parametric tests that do not require the assumption of normality.

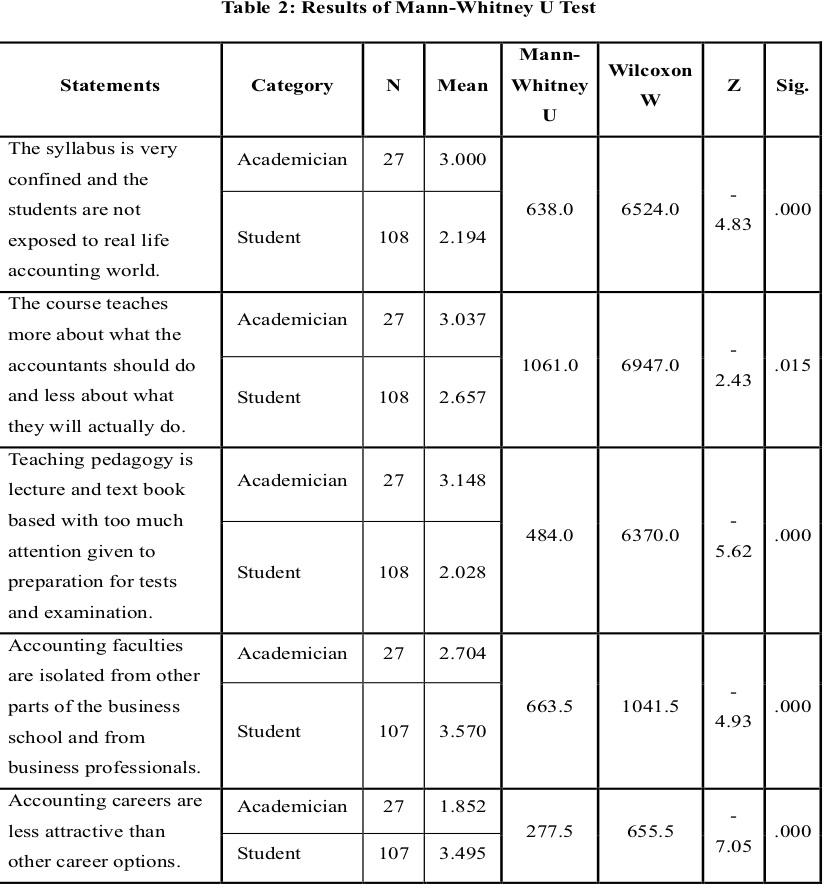

H01: The perceptions of accounting students as well as academicians do not differ significantly for contents of accounting curriculum. Table 2 displays the results of Mann-Whitney U Test for the perceptions ofaccounting students as well as academicians on the present accounting syllabus and teaching pedagogy. Only significantly different results have been presented. It was found that out of 8 statements, opinions of academicians and students were significantly different for 5 statements.

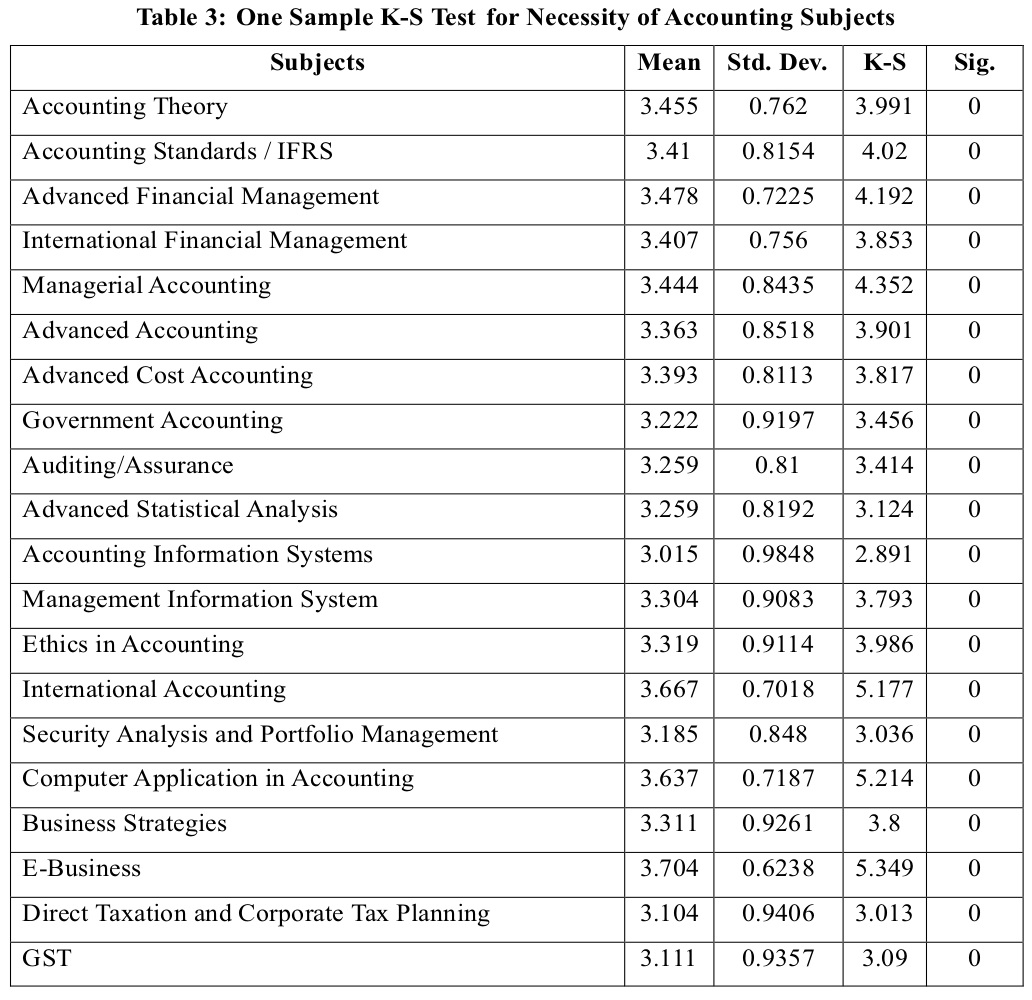

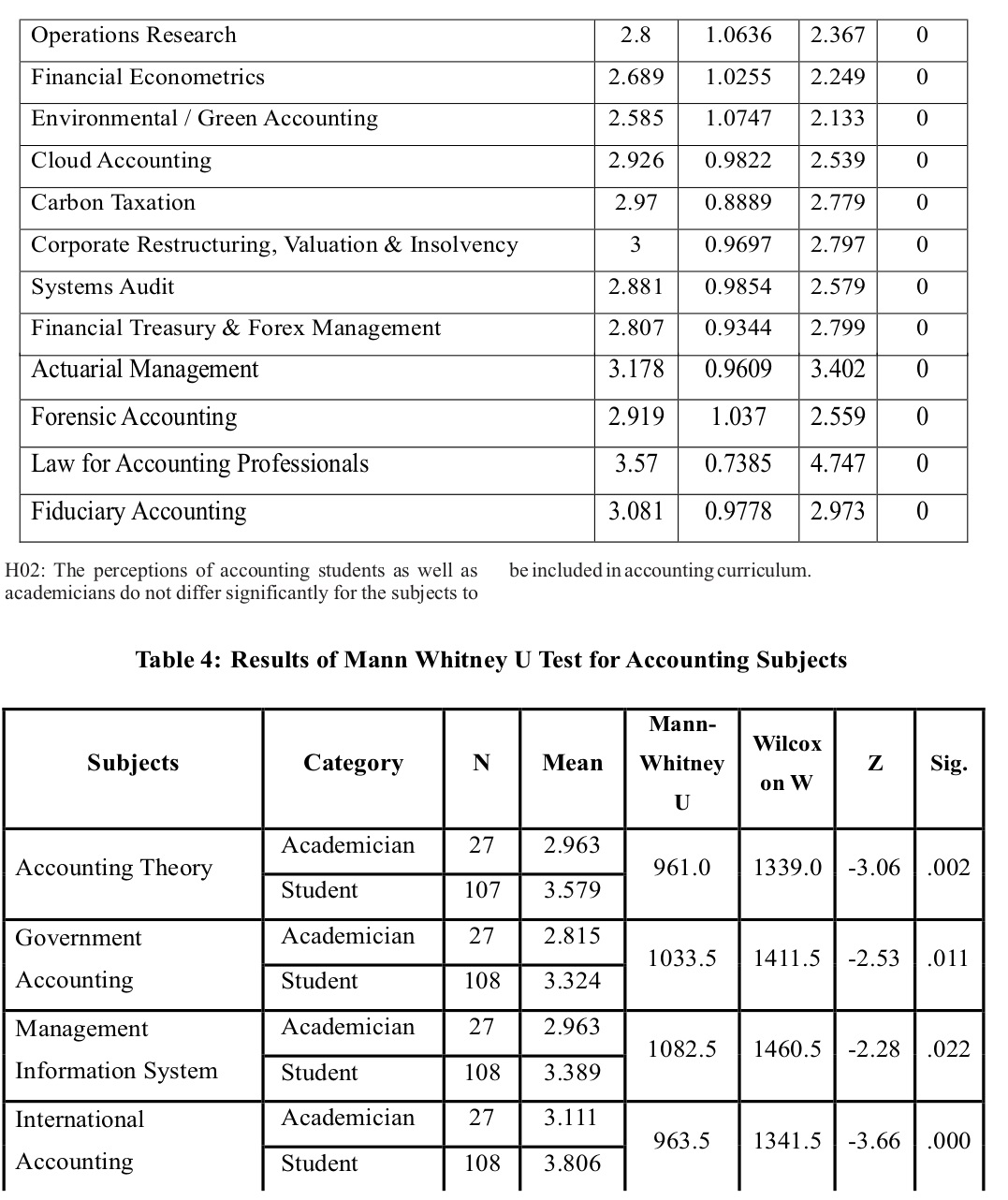

The neutral opinion being 2.5, academicians were on agreement side and students were on disagreement side for statements “The syllabus is very confined and the students are not exposed to real life accounting world”, “The course teaches more about what the accountants should do and less about what they will actually do” and “The course teaches more about what the accountants should do and less about what they will actually do”. Reverse is the case for “Accounting faculties are isolated from other parts of the business school and from business professionals” and “Accounting careers are less attractive than other career options”. Thus H01 is rejected at 5% level of significance. We also asked respondents regarding necessity of various traditional and contemporary accounting subjects/papers included/to be included in the accounting syllabus at PG level. Surprisingly, as revealed by Table 3, overall opinion for all subjects was significantly different from neutral opinion and that too, was on essential side. It implies that along with traditional subjects, respondents consider cotemporary subjects necessary to be included in accounting curriculum.

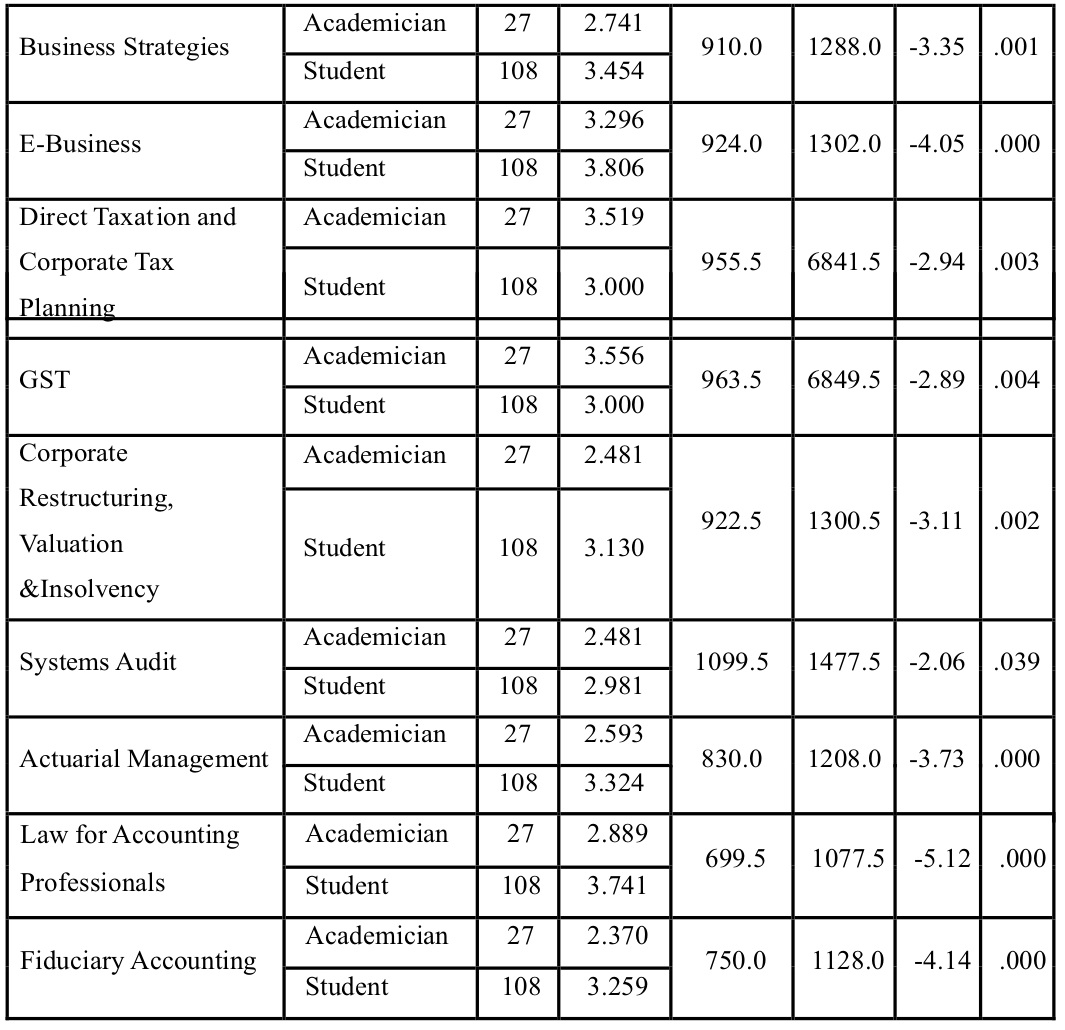

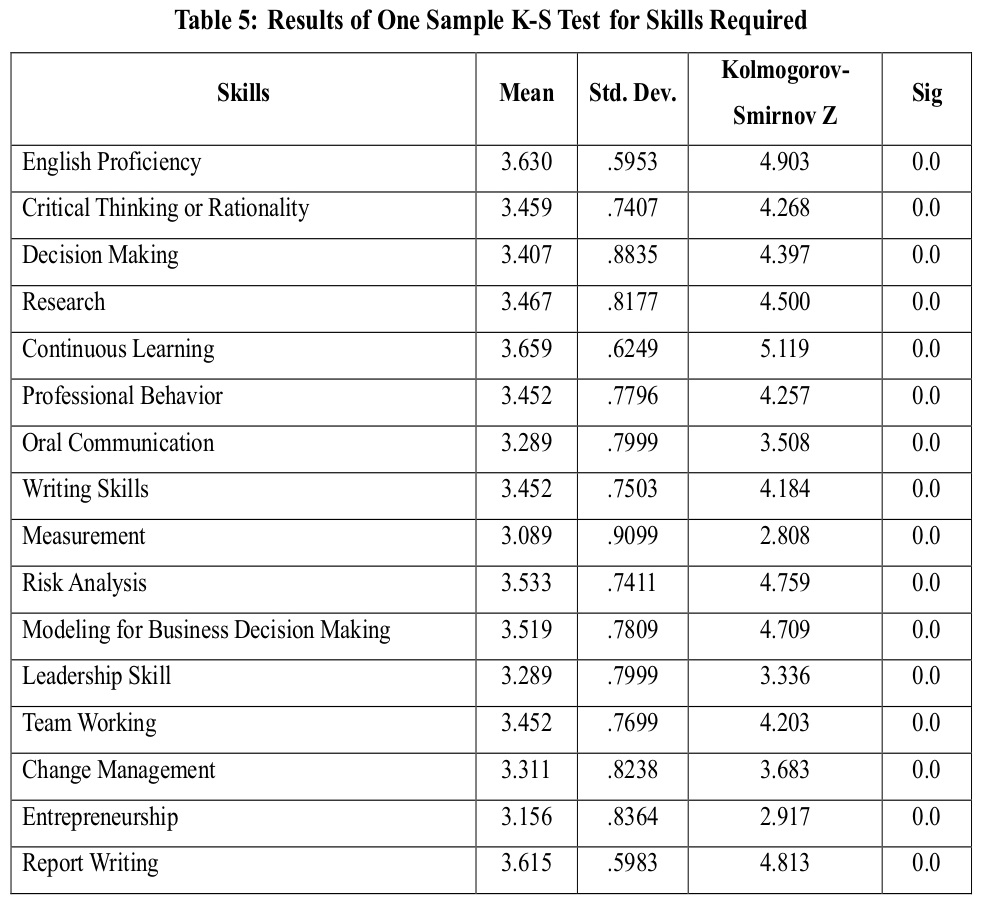

Table 4 presents significantly different result when tested on the basis of category of respondents. It was revealed from the results that out of 32 subjects, opinion for 13 subjects was significantly different from each other. Among them for 8 subjects Accounting Theory, Government Accounting, Management Information System, International Accounting, E-Business, Business Strategies, Actuarial Management and Law for Accounting Professionals both respondents are on agreement side but agreement of students was higher than that of academicians. Reverse is the case for Direct Taxation & Corporate Tax Planning and GST. For 3 subjects Corporate Restructuring, Valuation and Insolvency, Systems Audit and Fiduciary Accounting, academicians are on disagreement side whereas students are on agreement side. Hence H02 is also rejected at 5% level of significance. We then asked respondents about requirement of some basic skills in future accountants. Results of K-S test have been displayed in Table 5 where it was found out that for all the skills, overall opinion of respondents is significantly different from neutral opinion. Further, average opinions for all the skills are on agreement side.

• H03: The perceptions of accounting students as well as academicians do not differ significantly for required skills in accounting professionals

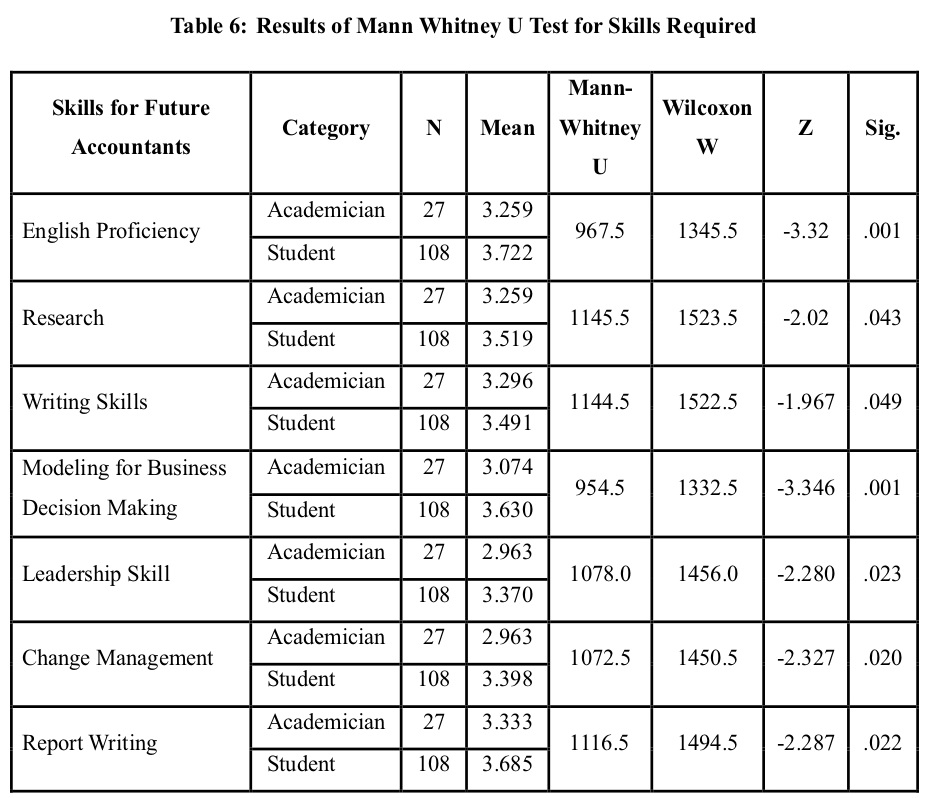

When it was attempted to find difference in opinion on the basis of category of respondents it was found that 7 out of 16 skills had significant difference between the opinions of two groups (Refer Table 6). Although, the opinions of both the groups are on agreement side, students are on higher agreement side than academicians. Hence H03 is also rejected at 5% level of significance.

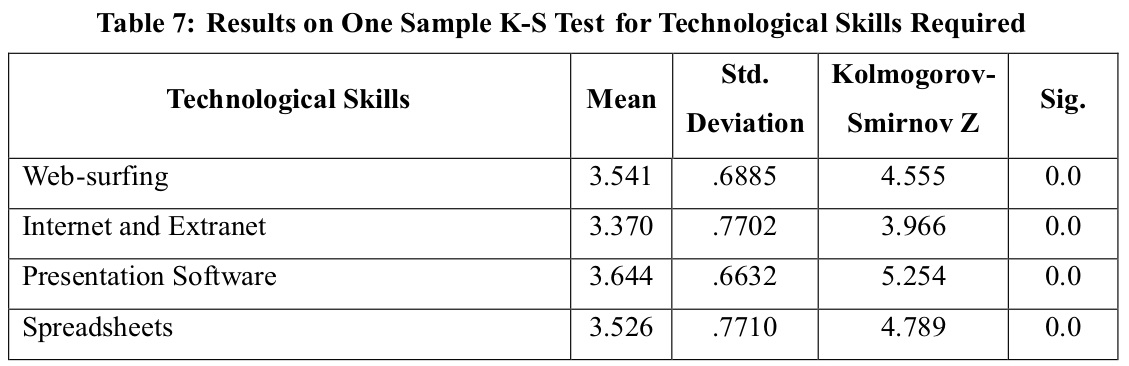

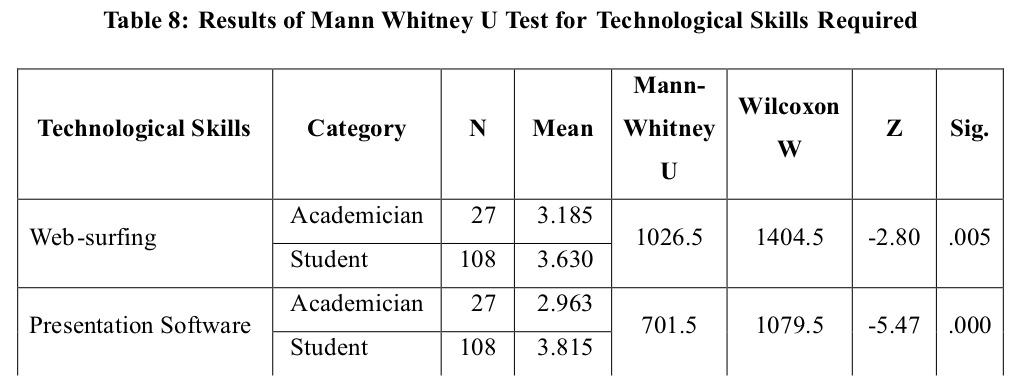

We then explored the respondents’ opinion towards essentiality of technological skills in future accountants. Table 7 displays the results of K-S test for these skills which reveals that here also, for all the technological skills, overall opinion of respondents is significantly different from neutral opinion. Further, average opinions for all the skills are on agreement side.

• H04: The perceptions of accounting students as well as academicians do not differ significantly for required technological skills in accounting professionals

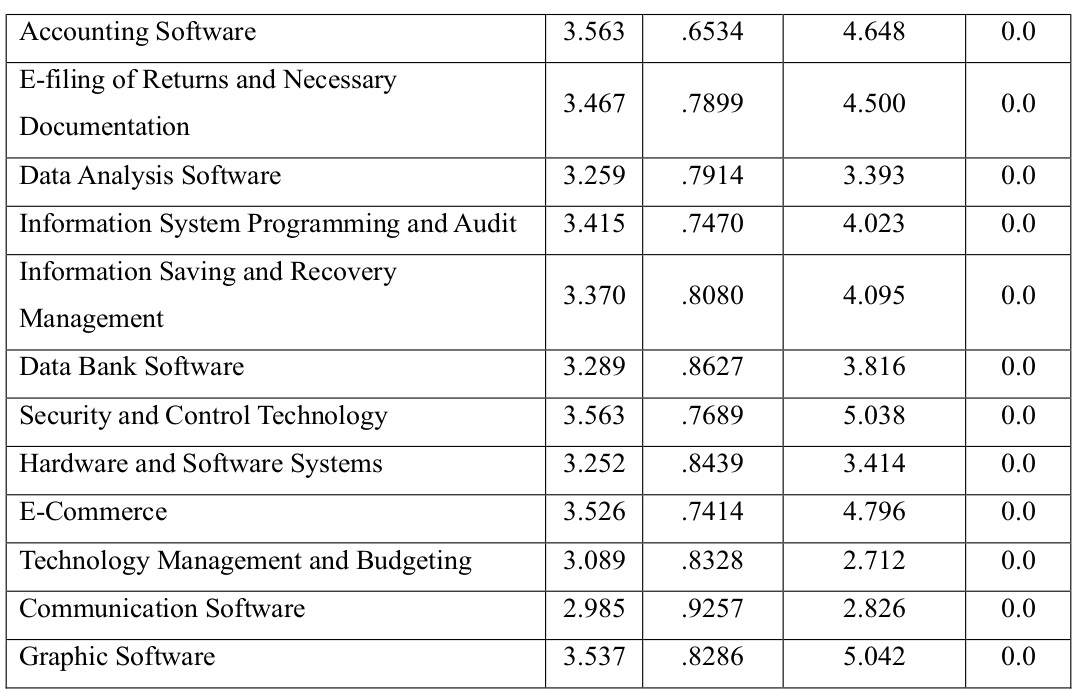

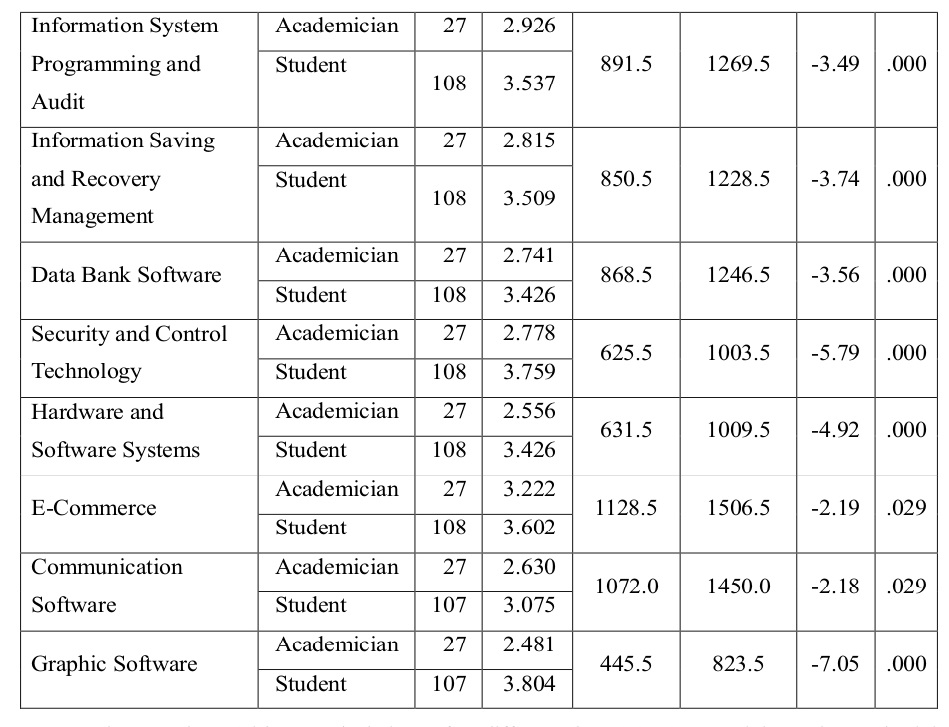

Table 8 contains the results of Mann-Whitney U test for finding the difference of opinion between the two groups. Difference was significant for 10 skills, where except Graphic Software; both groups were on agreement side with higher agreement of students group. For Graphic software, academician group is on disagreement side. Hence H04 is also rejected at 5% level of significance.

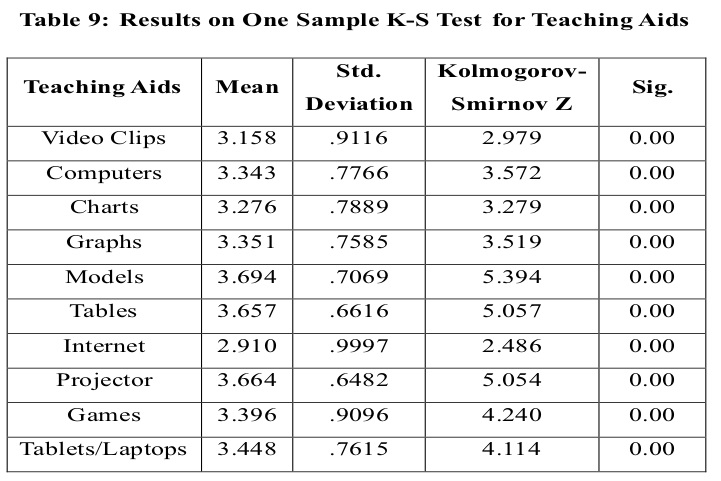

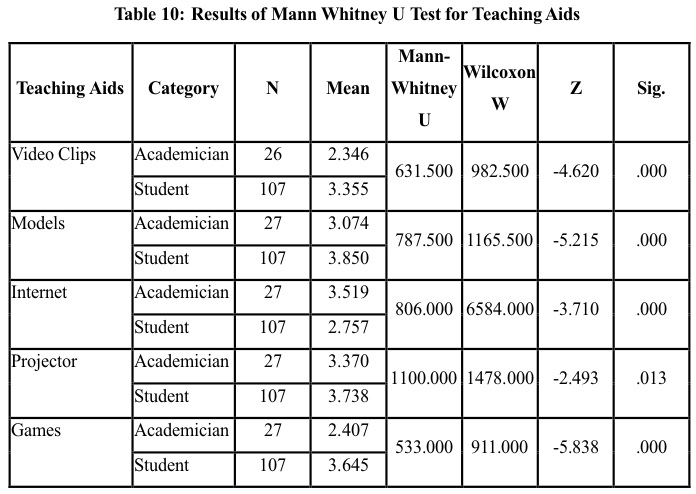

We then proposed respondents with several choices of teaching aids which they think are important for effective teaching of accounting subjects. Results of K-S test, as revealed by Table 9, confirmed the existence of significant difference between average opinion and neutral opinion for all the teaching aids proposed. Further, average opinions for all aids were on agreement side.

• H05: The perceptions of accounting students as well as academicians do not differ significantly for various teaching aids required for teaching accounting subjects.

Table 10 presents the results of Mann Whitney U test for these teaching aids and it was found that significant difference was found for 5 teaching aids. For Video Clips, Models and Projectors – both groups are on agreement side but agreement of students is higher than that of academicians. For Internet, reverse is the case. Academicians are on disagreement side for Games whereas students are in favor of it. Hence H05 is rejected at 5% level of significance.

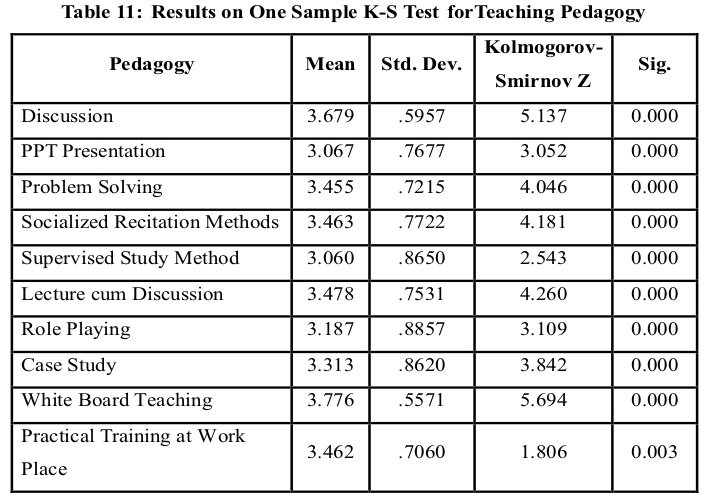

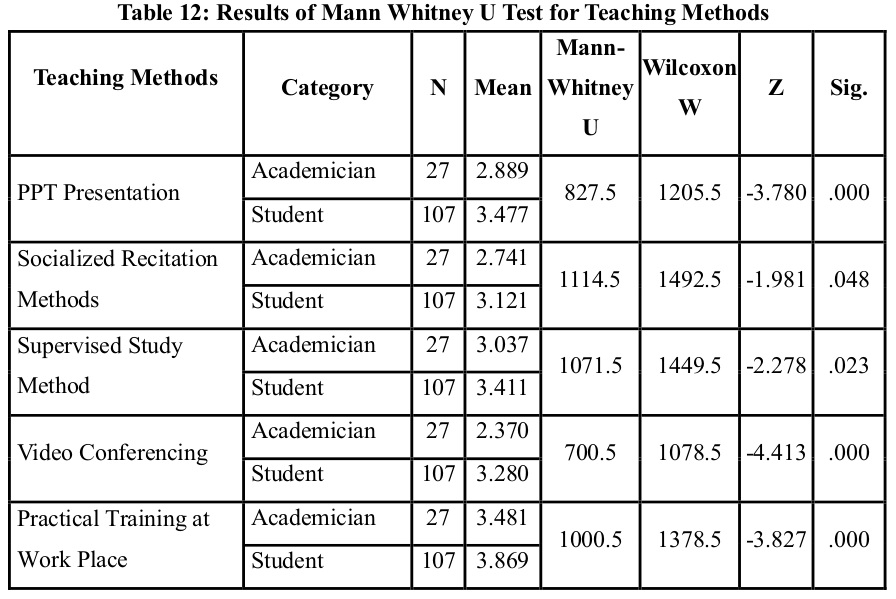

The analysis of last section which relates with teaching pedagogy is displayed in Table 11 and 12. Table 11 displays K-S test for teaching pedagogy which reveals that except for Video Conferencing, opinion for all teaching methods were significantly different from neutral opinion, that too, on agreement side.

• H06: The perceptions of accounting students as well as academicians do not differ significantly for various teaching methods for teaching accounting subjects.

Mann Whitney U test reveals (Refer Table 12) that only 5 teaching methods were significantly different from each other. Respondents of both groups are on agreement side for PPT Presentation, Socialized Recitation Method, Supervised Study Method and Practical training at Workplace, which comparatively higher agreement of students group. For Video Conferencing, academicians are on disagreement side whereas students are on agreement side. Hence H06 is also rejected at 5% level of significance

Present study is an attempt to explore perceptions of both academicians and PG students of accounting field regarding practical utility of accounting syllabus, accounting subjects, required skills, teaching aids and methods. A survey of 29 academicians and 109 PG students was conducted to find out their perceptions. The first and foremost finding was that gender was not the leading factor influencing perceptions relating to accounting syllabus, curriculum, skills etc. Both male and female respondents are in agreement towards inclusion of contemporary subjects in the curriculum, required latest skills in future accountants, inclusion of latest teaching aids and teaching methods. It was further concluded that category of respondents, i.e. academicians and PG students, was the influencing factor affecting their perceptions. It was interesting to know that academicians were not agreed with the current accounting curriculum, paper pattern, utility of accounting course in practical lifeetc. whereas students agree with these. On the other hand when academicians were asked about isolation of accounting faculties with other faculties and less attractive accounting career, they were on disagreement side. It shows that there is an urgent demand from their side to improve the curriculum, pedagogy, paper pattern and practical utility of accounting. With regard to accounting subjects it was found that towards contemporary subjects except direct taxation and GST, academicians are lesser agreement side than PG students. It shows that students are keener to learn new and cotemporary subjects as compared to academicians. These findings were then discussed with senior experts of the subject, who told that the reason behind such reluctance of academicians might be job insecurity, lack of exposure and lack of incentives or motivations for adoption of newer concepts, skills, subjects, teaching aids etc. But any confirmation of these reasons calls for further research. As far as basic and technological skills are concerned, students were again more in favour of requirements of skills than academicians. Some of the major skills favored were English Proficiency, Research, Modeling for Business decision making, Report Writing, Web Surfing, Presentation Software, Security and Control Technology, E-Commerce, Graphic Software etc. When respondents were asked about requirement of teaching aids, it was found that students are enthusiastic towards use of Video Clips, Models, Projectors and Games whereas academicians are little reluctant towards use of these aids in teaching accounting courses. With regard to teaching pedagogy, again students are more interested towards use of PPT Presentation, Socialized Recitation Methods, Supervised Study Method, Video Conferencing and Practical Training at Work Place. Here again, academicians are less agreed towards the use of it. These findings have important implications for curriculum preparers, paper setters, course directors, accounting faculties and students. The contents of most accounting programmes taught in higher institutions do not empower the students with knowledge of the real life situation that they will face when they practice Accounting. The paper also highlights the necessary skills required of a professional accountant in practice. In view of the above issue, the paper recommends that accounting training should be incorporated into the curriculum of accounting programmes offered. The postgraduate accounting education has to be oriented by market demands with an eye to upgrade students’ competence framework, and reset its training objective scientifically, build a rational curriculum system, optimize and strengthen its faculty construction to adapt the social demands and turn the accounting education into the cradle of prospective professional accountants.

• Albrecht, W.S. and Sack, R.J. (2000), “Accounting Education: Charting the Course through a Perilous Future”, Accounting Education Series, Vol. 16, American Accounting Association, Sarasota, FL. • Burrit, R. and Tingey-Holyoak, J. “Sustainability Accounting Research and Professional Practice: Mind the Gap”, Bridging the Gap between Academic Accounting Research and Professional Practice (2011),, The Institute of Chartered Accountants in Australia and Centre for Accounting, Governance and Sustainability University of South Australia: Australia. ISBN No: 978-1-921245-85-5. • Grosu, C., Almașana, A.C. and Circa, C. (2015), “Difficulties in the accounting research–practice–teaching relationship: Evidence from Romania”, Accounting and Management Information Systems, Vol. 14(2), pp. 275-302 • Johnson, R. (2014), “Accounting Practitioners Reflect on Faculty Impact: Bridging The Gap Between Theory and Practice”, American Journal of Business Education, Vol. 7 (2), p.p. 109-114 • Mashayekhi, B. and Mohammadi, R. (2014), “The Perceived Gap Between Academics and Professionals about Accounting Education System in Iran”, Science Journal of Education. Vol. 2 (1), pp. 12-21. doi: 10.11648/j.sjedu.20140201.13 • Paino, S. and Puteh, M.S. (2006), “A Study on Accounting Curricular and Future Accounting Graduates”, Gading Business and Management Journal, Vol. 10 (2), pp. 13-30 • Suryawwthy, G.A., and Putra, G.C. (2014), “Bridging the Gap Between Accounting Education and Accounting in Practice: The Case of UniversitasMahasaraswati Denpasar”, Asia Pacific Journal of Accounting and Finance Special Issues: “The Accounting Profession towards ASEAN Economic Community“ Vol. December 2014, pp.59-72 • Turner, K.F, Reed, R.O. and Greiman, J. “Accounting Education in Crisis”, American Journalof Business Education, Vol.4 No.12, pp. 39-44. • Vroeijenstijn, T.I. (1995) “Quality assurance in medical education”, Academic Medicine, Vol.70 (7), pp.59-67. • Wally-Dima, L. (2011) “Bridging the Gap between Accounting Education and Accounting Practice:The Case of the University of Botswana”, The IUP Journal of Accounting Research & Audit Practices, Vol. X (4), pp. 7-27 • Watty, K. (2005), “Quality in Accounting Education: What say the academics?”,Quality Assurance in Education, Vol. 13 (2 ), pp. 120-131. • Yuan, S. and Lou, Y. (2015), “Study on Reform of Accounting Education Mode of Higher Vocational Schools Based on Training in High-Caliber Professional Accountants”, 2nd International Conference on Education Reforms and Modern Management (ERMM, 2015), pp. 5-8