|

Diep T.N.Nguyen Lac Hong University Bien Hoa City, Viet Nam Email: ngocdiep1980.dhlh@gmail.com |

: The paper examines the correlation between performance variables (ROA, ROE) and the components of macro governance variables and other bank-level variables. The highlight of this study is the use of the World Bank Governance Index dataset to assess the impact of macro-level governance factors on the performance of ASEAN commercial banks in the period from 2010-2017. The sample consists of 86 commercial banks in 5 ASEAN countries namely Vietnam, Thailand, Malaysia, Indonesia, Philippines. The findings show that the micro-level variables that significantly affect the performance of the commercial banks are SIZE, SALEGR, ASSETGR, and macro-level factors VAE and GOVINDEX. The impact of VOLATILITY, LEV and PVE on the performance of banks in ASEAN countries is not found.

Keyword: Governance, Bank Performance, ASEAN.

Economic integration is a certain trend in the world, and the establishment of multilateral and bilateral relations among nations brings practical benefits to the parties. Commercial banks help bridge the flow of capital between exporters and importers, between countries, attracting visitors from outside the region to use the products and services, contributing to the promotion of payment channels and the development of trade transactions among ASEAN countries in the past years. According to Arugay (2017), ASEAN is considered one of the most promising regional organizations in the world after 51 years of establishment. Since 1999, ASEAN's GDP growth rates have always been positive and been ranging from 2.5% to 7.5%. Levine (2005) and Beck (2009) suggest that a well-functioning financial system is essential for a market-oriented economy to thrive. From the above benefits, it is clear that developing countries are concerned about improving the performance of the commercial banking system and those in the ASEAN region are no exception. Therefore, the issue of macro governance of commercial banks in the modern context is important more than ever to bring about the best performance for the banks. There are numerous domestic and international studies on the relationship between governance and firms’ operating performance, with governance factors including both micro- and macro-level factors such as Choi and Hasan (2005), Lee (2005), Spatarean (2005), Tandelilin et al. (2007), Love and Rachinsky (2008), Grobi and Levratto (2008), Sinha (2008), Hossain's (2007), Kyereboah-Coleman and Biekpe's (2006), Douma et al. (2006), Delfino (2007), Barako and Tower (2007), Athanasoglou et al. (2005), Nicolae Petria, Bogdan Caprarub, Iulian Ihnatovc (2015), Nguyen Thi Diem Hien and Nguyen Hong Hat (2016), and Tran Huy Hoang and Nguyen Huu Huan (2016). These studies have explored macro and micro factors; however, inconsistent research findings emerge. Nonetheless, there have been no studies on the relationship between corporate governance and bank performance using macro-level governance indexes(from World Bank Governance Index), at least in the context of emerging countries such as ASEAN in the period 2010-2017 which is considered to be the period of high growth of the banking industry (Doing Business Report, 2018). ASEAN is arguably the leading region in terms of sustainable economic growth (Yasuhiro Yamada, 2017). Commercial banks in ASEAN countries can recognize the magnitude and direction of the impact of the variables in order to develop appropriate policies to promote their operating efficiency. This is important because in the long term, the performance of commercial banks will further economic growth in the region.

Corporate governance is a system of guidelines and principles meant for board of directors as a best practice to serve their roles in an appropriate and satisfactory manner. Corporate governance helps to mitigate moral hazard problems. This system is a framework comprising of rules and practices through which, if conducted effectively, the accountability, transparency and fairness in the relationship between a firm and its stakeholders can be secured. The stakeholders mentioned include, but not limited to, fund providers, customers, managers, employees, government and the local community. In their operations, firms mobilize and mix inputs including capital, labour, materials and expertise of managers in the production process where outputs are goods and services necessary for the society members. Corporate governance helps in every stage of a firm’s operations: it provides framework of conducts forall the stakeholders to resort to, involved rights, obligations, challenges within a firm (Healy, 2003). Cohen and Boyd (2000) argue that due to the importance of firms in the society, it is crucial to make sure that firms function properly in their operations, in financial, political and even ethical matters. Corporate governance can be affected by macro-governance factors. For example, the power of the board of directors or the right of debtholders to seize firms’ assets lie with the lawful framework and the ability to enforce the law. In the present study corporate governance therefore is under influence of both macro and micro elements.

Performance drivers are one of the most important and widespread issues in financial analysis because the efficiency of the business involves the interests of shareholders, managers, creditors and others stakeholders whose interests are associated with the business. Depending on the different research objectives, performance is considered in different aspects. Normally, bank performance is reflected through its operating and financial performance. In particular, financial performance is the most commonly studied subject in the study of performance. Performance reflects the ability to exploit and use resources in the process of reproduction to achieve the business goals with the lowest cost and the highest efficiency. Currently there are many ways to measure the performance of a business. The study by Hult et al. (2008) opines that three performance measures can be used: financial efficiency, business efficiency, or overall efficiency. Financial performance in many studies includes ROA, return on equity (ROE), return on investment (ROI), return on sales (ROS). Business performance is measured by market share, frequency of new product launches and innovations, quality of goods and services, productivity, satisfaction and retention of labor force. Overall performance often includes credibility, viability, and level of achievement of the target compared to that of competitors. There are many indicators to measure financial performance and each indicator has different strengths and weaknesses. However, to assess the performance of a bank, two common ROE and ROA indicators are used to measure the performance of the commercial banks. Return on equity (ROE): Calculated by dividing net income by average equity (common equity, preferred shares, reserves and undivided profits). ROE measures the rate of return for bank shareholders. It represents the income that shareholders receive from investing their capital. This indicator shows the performance of the bank, its profitability per unit of equity. Return on asset (ROA): ROA is a measure of the effectiveness of a bank's management, showing the ability to transform a bank's assets into net income. This indicator shows the quality of asset management. The larger the ability of assets to generate profit, the higher the indicator.

These governance indicators are collected from 199 countries and territories, which incorporate the views of a large number of businesses, individuals and surveyors in both emerging and developed countries. They are based on more than 30 data sources produced by survey institutes, consulting groups, NGOs, international organizations and private manufacturing firms (Kaufmann, Kraay and Mastruzzi, 2010). The Governance Index of the World Bank consists of six components: (1) Voice and Accountability: judged by the extent to which citizens of a country can participate in the choice of government as well as freedom of speech, associations and the media. (2) Political Stability and Absence of Violence: measured by the possibility that a government will be destabilized by violence, including terrorism. (3) Government Effectiveness: measured by the quality of public services, the capacity of civil service and their independence from political pressure, and the quality of policy development. (4) Regulatory Quality: measured by the ability of a government to provide appropriate policies and regulations that allows and promote private sector development. (5) Rule of Law: measured by the degree to which agents trust and abide by social norms, including the quality of property rights, the police and the courts, and the risk of crime. (6) Control of Corruption: measured by the extent to which public power is exercised for personal gain, including small and large forms of corruption. If a country is rated as good in the above six indicators, it is expected to bring about a decent operating environment, facilitating efficiency enhancement for commercial banks, and this is an important measure of macroeconomic governance of the economy of ASEAN countries.

There are a large number of studies on corporate governance and bank performance, and this link has become a worldwide concern, especially during times of economic crisis. Previous studies on the relationship between corporate governance and bank performance could be categorized into the following items: This link between ownership structure and performance banks has long been explored. Choi and Hasan (2005) look at the effect of ownership and corporate governance on Korean banks during 1998-2002 estimated with the OLS model, and argue that foreign directors help improve the efficiency of the bank. Lee (2005) examined the effectiveness of management ownership using a sample of Korean banks in the period 1994- 2000. The findings suggest that managers of banks in higher moral hazard groups will be more motivated to adapt to the interests of shareholders. Love and Rachinsky (2008) investigate the link between ownership, performance and corporate governance in the banking sector using a large sample of Russian and Ukrainian banks from 2003-2006. The findings show that there is a statistically but not economically significant link between corporate governance and bank performance. Using a dataset of 51 Indonesian banks from 1999 to 2004, Tandelilin et al. (2007) also assess the correlation among bank risk, governance and bank performance. The results show that bank ownership influences both the link between governance and bank performance, and governance and risk management. It is noteworthy that there is no evidence of a linear effect of governance on bank performance. Using a sample of 40 Indian commercial banks, Sinha (2008) performs a DEA analysis for the total period from 2000 to 2006. The findings show that in 2000-2001 private banks did not perform as well as public banks, while from 2005-2006 private banks did better than the public ones. Hossain (2007) uses a sample of 38 Indian banks in the period from 2002 – 2003 and performs regressing to examine the link between corporate governance disclosure on firm performance. Hossain finds that Indian banks highly abide by the corporate governance disclosure regulations. Kyereboah-Coleman and Biekpe’s (2006) study the governance mechanism: board of directors and CEOs and bank performance in Ghana from 1997 to 2004. The authors suggest that there is a positive link between board size and ROA, while CEO’s tenure has negative impact on ROA. Kapopoulos and Lazaretou (2007) use a sample of 175 Greek listed firms to examine whether ownership structure influences firms’ performance in terms of profitability. The results show that there is a positive correlation between ownership structure and profitability of firms in Greece. Also, the higher the concentration of the shares in external or internal shareholders, the more efficient the firm. Delfino (2007) investigates the impact of changes in corporate governance (due to privatization, mergers and acquisitions) on the performance of banks in Argentina from 1993 – 2000. The authors argue that state-owned banks are not as efficient as private ones, and that foreign investors’ acquisitions result in better performance in terms of productivity of acquired banks, though bank efficiency is not affected by this. Barako and Tower (2007) examine the link between ownership structure and bank performance in Kenya. The results show that there is a strong impact of ownership structure on bank performance, measured by ROA. Board ownership negatively correlates with bank performance, and institutional shareholders have no impact on performance. Finally, foreign ownership exerts positive influence on banks’ performance. Using a large dataset of firms from different industries in 1999-2000, Douma et al. (2006) study the role of foreign ownership, which is separated into foreign institutions and foreign individuals, towards firm performance. The findings suggest that the effect of foreign institutions on firm performance is ambiguous. In the meantime, domestic firms have higher firm performance. Nonetheless the coefficients of domestic investor’s impact is less significant compared to that of foreign firms. Lensink and Naaborg (2007) examine the impact of foreign ownership on banks’ revenue and profitability, and use a sample of 511 banks from 73 countries. Lensink and Naaborg (2007) perform GMM estimation technique and document that an increase in foreign ownership leads to a decrease in bank performance in terms of net interest margin and profitability. This is consistent with home field advantage theory. On the contrary, banks that have limited foreign ownership have better profitability and higher ability to generate higher net interest margin. Athanasoglou and ctg. (2005) study the factors affecting the performance (ROA) of banks in Eastern Europe for the period 1998-2002. The results show that for Eastern European banks, the increasing level of financial reforms and the improving capital structure of credit institutions are the decisive for the bank's profitability. Inflation has a profound effect on profit, while bank profits are not significantly affected by changes in real GDP per capita. In addition, the factors affecting the performanceare also internal factors to the bank. Nicolae Petria, Bogdan Caprarub and Iulian Ihnatovc (2015) look at the main drivers of ROAE and ROAE) in the EU27 during 2004-2011. Using the fixed effects model, the authors provide results show that bank size, credit risk, liquidity risk, management efficiency, aggregate business index, inflation and economic growth affect the performance (ROAA and ROAE). Ongore and Kusa (2013) show that asset quality, capital adequacy and effectiveness for board members influence the effectiveness of the commercial banks. Liquidity is not significant in determining bank performance. Capital adequacy and management efficiency have a positive effect, while asset quality has a negative impact on bank performance, suggesting high NPLs and/or low asset quality have a negative impact on bank performance. Tran Huy Hoang and Nguyen Huu Huan (2016) study the factors affecting the performance of the Vietnam commercial banks during the integration period 2005 - 2011 using 2SLS and Tobit models. Research results show that the performance of commercial banks is influenced by several factors: market share, liquidity risk, ownership ratio of foreign investors outside and scale of the bank. External factors include: gross domestic product and inflation of the economy. The factors that have a positive impact on the performance of the commercial banks are: the ownership of foreign investors, the size of the bank and the market share of the bank. Grobi and Levratto (2008) examine theoretically the influence of private ownership on bank performance for a group of banks in Bulgaria and Hungary. It is found that in these two countries private ownership is important, especially when combined with decent corporate governance. Roe (2004) examines the atonomy of corporate governance in the Western countries, focusing on the two aspects: vertical governance (between distant shareholders and firm managers) and horizontal governance (between close and controlling shareholders and distant shareholders). Hassan et al. (2004) analyze the agency problems in banking sector, specializing in corporate governance aspect. The authors find that in emerging countries corporate governance is not as strong as issues such as information asymmetry, agency cost and corruption as well as the issue of instable accounting practices, all of which can negatively influence all stakeholders. In conclusion, there are a lot of studies on the impact of corporate governance on the operations of banks or businesses in general and show different results for extent of this impact. However, very few studies are concerned with the link between bank performance and macro-level factors such as World Bank Governance Indicators, and this spells a significant gap which will be filled in this study.

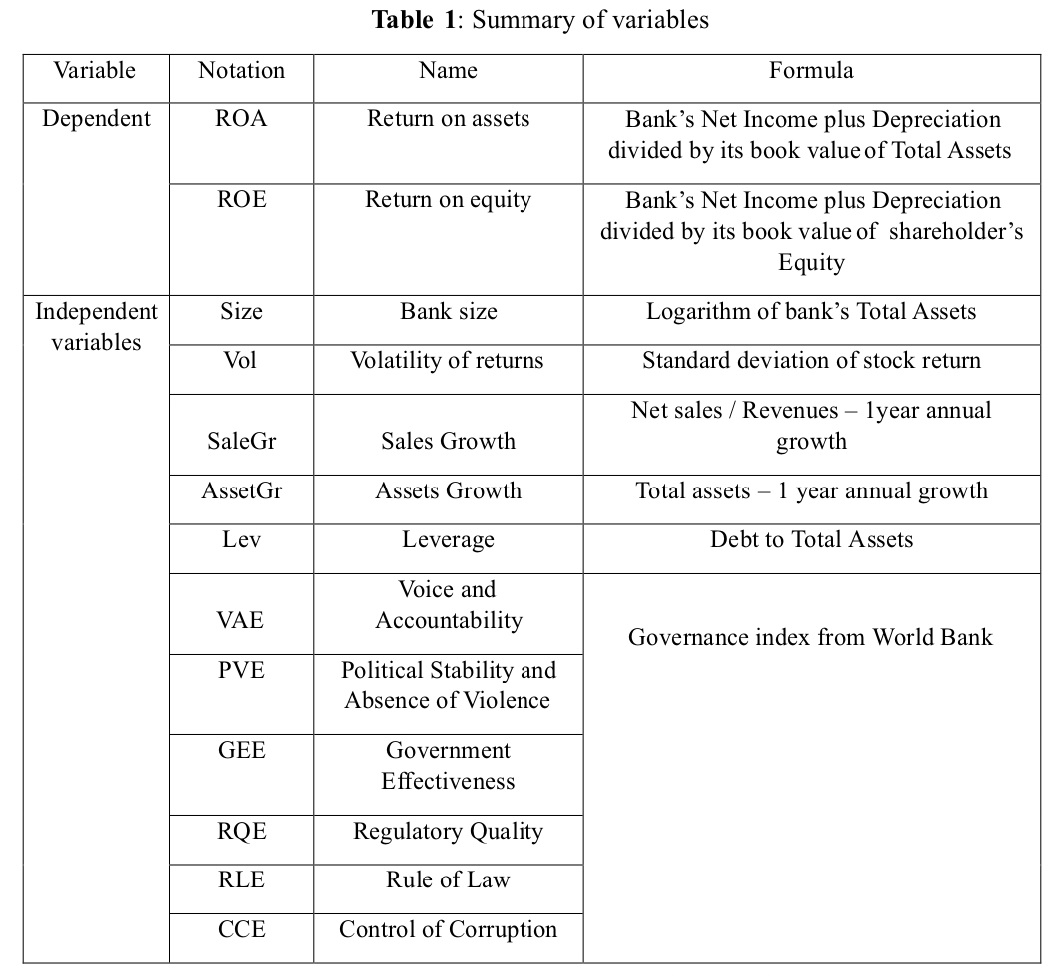

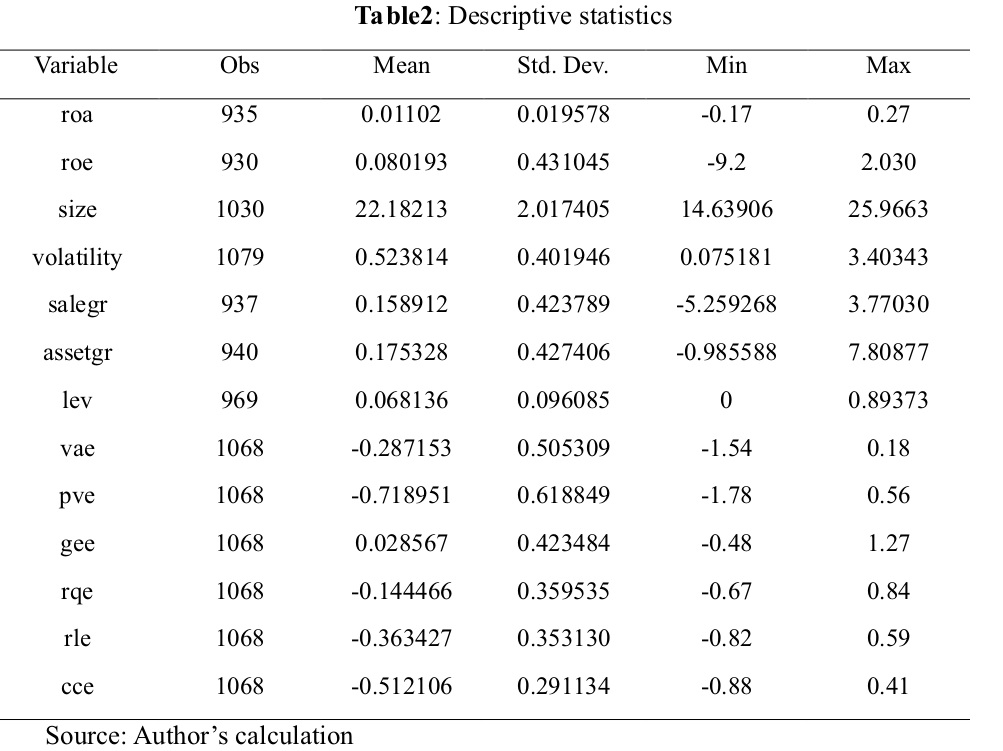

The data were compiled from the consolidated finance reports, annual reports taken from Thomson Reuter of 86 commercial banks in 5 ASEAN countries including VietNam, ThaiLand, Malaysia, and Indonesia, Philippines for the study period from year 2010 – 2017 and Worldbank. The study utilized unbalanced panel data with the Random Effects Model (REM), and data processing is conducted using the Stata14 software. The study uses the following variables:

Performance = f(Size, Volatility, Sales growth, Assets growth, Leverage, Nation, Governance ) + ε Where: Dependent variable is Performance, measured by ROA. Independent variables include (1) internal variables of commercial banks: SIZE, VOLATILITY, SALEGR, ASSETGR, LEVERAGE; (2) and the macroeconomic factors measured by the Governance Indicators of the World Bank which are VAE, PVE, GEE, RQE, RLE, CCE. ε is the error term

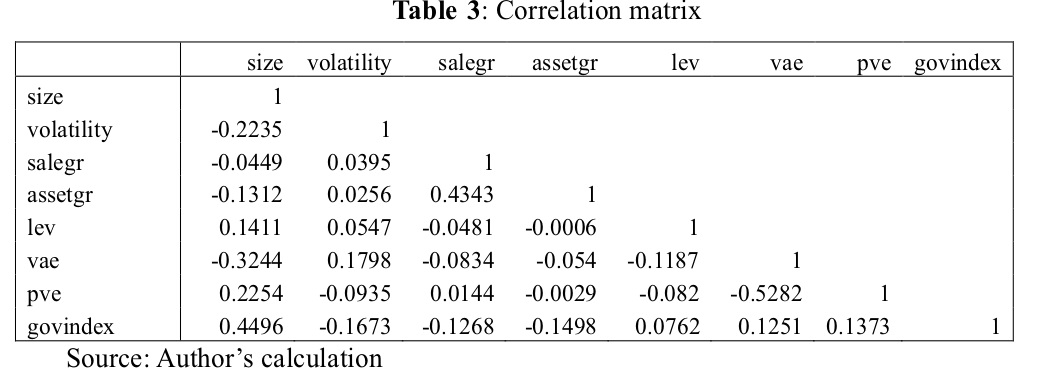

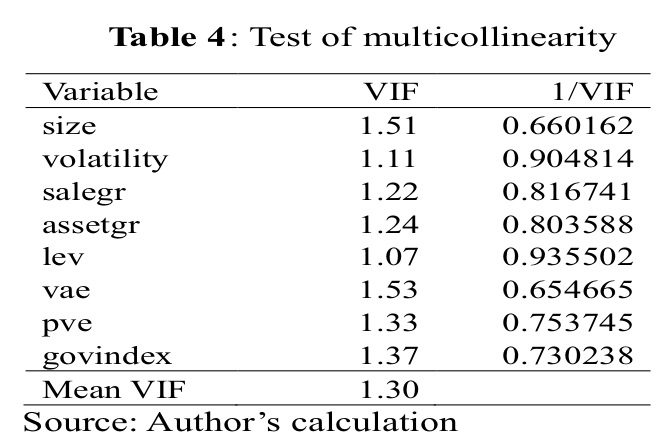

Table 3 shows the correlation between the variables in the model for an overview of the correlation of selected variables. The variables in this study were collected by year of commercial banks in 5 ASEAN countries. From the correlation matrix as well as Variance Inflation Factor, the author discovers a large correlation among some variables. To overcome this situation, the author performs the Principal component analysis to reduce the dimension of the variables, and is able to group and form an index from 4 variables GEE, RQE, RLE, CCE (GOVINDEX). Variance Inflation Factor test is then performed (Table 4) to examine whether multicollinearity still exists and it is found that this is now no longer a major issue.

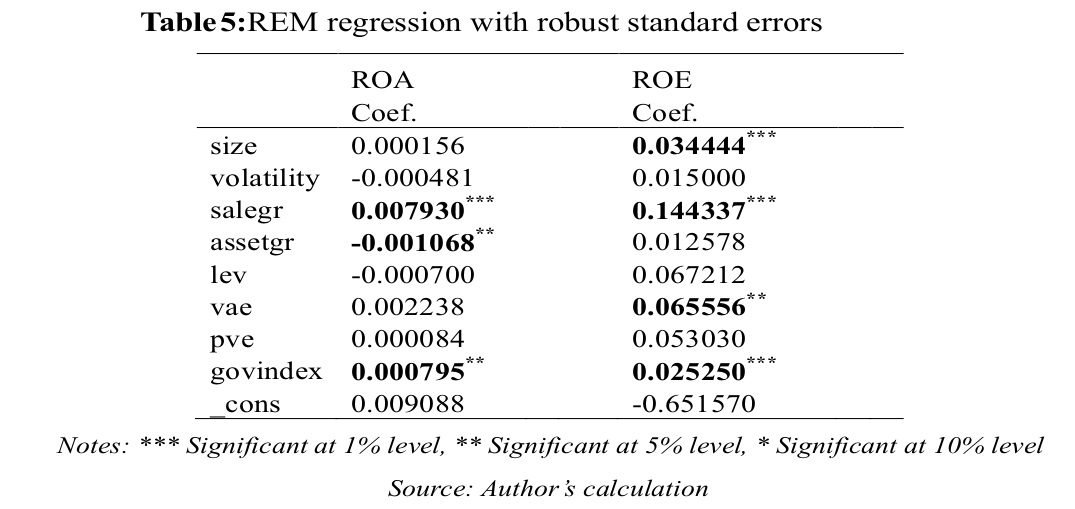

The study uses random effects model to examine the correlation and impact of internal variables of commercial banks and the Governance Indicators on the performance of commercial banks. Tests of heterokedasticity and autocorrelation suggest that there exist both of them. To address these issues, the study perform a random-effects regression with robust standard errors (RE-robust) to yield more valid regression results as shown in Table 5.

In Table 5, for micro-level variables, revenue growth is positively and statistically significant at 1% for both ROA (0.0079) and ROE (0.1443). It can be said that the efficiency of the commercial banks of the five ASEAN countries is under positive influence from the increase in sales in the period 2010-2017. This is due to the outstanding growth of the region, reflected in recent impressive figures (e.g. in 2016 GDP of ASEAN ranked sixth in the world and ranked third in Asia with USD 2.55 trillions). This development has made a great contribution to the development of trade among countries, and acts as a bridge between the flow of capital among enterprises that has promoted payment channels. Therefore, in addition to profits from the traditional loans, banks benefit from the increase of fees and services, contributing to the increase in sales made by banks in the region. In addition, the study also finds that higher the ASSETGR (AssetGR) has a significantly negative impact on ROA (-0.00106), but the study found no statistically significant impact in the case of ROE. In contrast, size of the bank (SIZE) hasa positive impact on ROE (0.034444). This finding is consistent with that of Tran Huy Hoang and Nguyen Huu Huan (2016). The study did not find any significant effect of SIZE on ROA, and this result is consistent with the study of Goddard, Molyneux and Wilson (2004), Choi and Hasan (2005), but inconsistent with the study Nicolae Petria, Bogdan Caprarub, Iulian Ihnatovc (2015). In addition, the study did not find statistically significant effects of VOLATILY and LEV on ACTIVITY. The results in Table 5 suggest that macro-level governance variables have a significant effect on the performance of the ASEAN commercial banks. The results of this study are consistent with studies by Love and Rachinsky (2008), Tandelilin et al. (2007) who document a relationship between performance and corporate governance. Macro-level governance variables were evaluated based on the criteria of the Governance Indicator that showed a heterogeneous impact. Specifically, the GOVINDEX variable includes the effects of Government Effectiveness, Regulatory Quality, Rule of Law, Control of Corruption, exerting a positive and statistically significant effect on both ROA and ROE. This results in the fact that governments in ASEAN have established regulations and policies that are consistent, politically stable, and comply with social norms, including quality of ownership, allowing and promoting private sector development have a positive impact on the performance of the ASEAN Commercial Banks. The trade policies of the region in recent years have brought about certain outcomes,in particular intra-ASEAN market. This market plays a big role in the trade development of the association. ASEAN countries have included the ASEAN Trade in Goods Agreement (ATIGA) and the Common Effective Preferential Tariff (CEPT) Agreement on the elimination of tariff barriers, aiming at increasing trade efficiency and strengthening economic linkages among member countries. In addition, the results of the study also show that the VAE variable has a positive and significant effect on ROE but this effect is not large. However, this result implies that, for ASEAN countries, the issue of Voice and Accountability has also been emphasized and it also contributes to the performance of commercial banks by the extent to which citizens of a country are able to participate in governmental choice as well as freedom of speech, and government-regulated associations and newspapers will bring about a better business environment, contributing to better performance of banks. This result is consistent with Hassan's theoretical study, Wolfe and Maroney (2004), suggesting that corporate governance is weak in developing countries due to information asymmetry, corruption, inexperienced market participants and weak judicial systems, and greater systemic risk they face. As a result, the corporate governance structure cannot contribute to the stability and efficiency of the bank. In addition, the study did not find the impact of VAE on the performance of ASEAN commercial banks.

The research shows that there is evidence of a relationship between governance factors and performance of ASEAN commercial banks. Additionally, there is a positive link between sales growth and performance. To the best of the author’s knowledge, this is the first paper that examines the role of macro-level governance factors on banks’ performance in emerging countries. The implications from this study are that, governments in ASEAN need to improve policies, procedures and control of corruption in parallel with allowing and promoting private sector development. Further research can be done on other effectiveness measures such as return on investment and P/E for a more comprehensive assessment of the relationship between macro-level governance and performance of commercial banks.

[1]. Arugay A. A (2017). The Next 50 Years of ASEAN: Overcoming irrelevance and polarization are ASEAN’s biggest challenges as it heads into the future.https://thediplomat.com/2017/07/the-next-50-years-of-asean/ [2]. Athanasoglou, Brissimis and Delis. (2005). Bank-specific, industry-specific and macroeconomic determinants of bank profitability. https://mpra.ub.uni-muenchen.de/32026/1/Bank-specific.pdf. [3]. Beck (2009). Critical Theory of World Risk Society: A Cosmopolitan Vision. Constellations Volume 16, No 1, 2009.Page 3-22 [4]. Barako, D. G. and Tower, G. (2006). Corporate Governance and Bank Performance: Does Ownership Matter? Evidence from Kenyan Banking Sector. Corporate Ownership and Control, 42, pp. 133 – 144 [5]. Choi and Hasan (2005). Ownership, Governance, and Bank Performance: Korean Experience. Financial Markets, Institutions & Instruments, Vol. 14, No. 4, pp. 215-242, November 2005 [6]. Cohen S and Boyd G, Corporate Governance and Globalization: Long Range Planning Issues (2000). [7]. Grobi and Levratto (2008), “The role of social norms for the relationship between private ownership and the performance of banking sectors in transition countries: the cases of Bulgaria and Hungary as examples”, Corporate Ownership and Control/Volume 5, Issue 2, 68-86, Winter 2008 [8]. Delfino Maria Eugenia (2007), “Control Changes and Firm Performance in Banking”, Int. J. of the Economics of Business, Vol. 14, No. 2, pp. 261 - 281, July 2007 [9]. Douma S., Rejie G., Rezaul K., (2006). Foreign and domestic ownership, business groups, and firm performance: evidence from a large emerging market. Strategic Management Journal, 27, 637-657. [10]. Doing Business Report, 2018. Comparing Business Regulation for Domestic Firms in 190.Economies. A World Bank Group Flagship Report. http://www.doingbusiness.org/~/ media/WBG/DoingBusiness/Documents/Annual-Reports/English/DB2018-Full-Report.pdf [11]. Hassan, Wolfe and Maroney (2004).Corporate control and Governance in banking. Corporate Ownership & Control .Volume 1, Issue 4, 94-107 Summer 2004. [12]. Hossain’s (2007). Obesity and diabetes in the developing world--a growing challenge. The New England Journal of Medicine. DOI:10.1056/NEJMp068177 [13]. Healy J,(2003). Corporate Governance and Wealth Creation in New Zealand. ISBN: 08.646.9425.3128. [14]. Hult G. T. M. et al (2008), “An assessment of the measurement of performance in international business research”, Journal of international business studies 39, pp. 1064-1080. [15]. Kyereboah-Coleman and Biekpe’s (2006). The link between corporate governance and performance of the non‐traditional export sector: evidence from Ghana. Corporate Governance: The international journal of business in society, Vol. 6 Issue: 5, pp.609-623, https://doi.org/10.1108/14720700610706090 [16]. Kaufmann.D, Aart Kraay and Massimo Mastruzzi (2010). "The Worldwide Governance Indicators : A Summary of Methodology, Data and Analytical Issues". World Bank Policy Research Working Paper No. 5430, http://papers.ssrn. com/sol3 /papers.cfm?abstract _id=1682130 [17]. Lee (2005).Moral hazard, agency problem and ownership structure. Corporate Ownership and Control/Volume 3, Issue 2, 116-124, Winter 2005-2006. [18]. Levine (2005). Finance and Growth: Theory and Evidence. NBER Working Paper No. 10766. Issued in September 2004. DOI: 10.3386/w10766 [19]. Love and Rachinsky (2008).Corporate Governance, Ownership and Bank Performance in emerging markets: Evidence from Russia and Ukraine. [20]. Ongore V.O and Kusa. G.B (2013). Determinants of Financial Performance of Commercial Banks in Kenya, International Journal of Economics and Financial Issues. Vol. 3, No. 1, 2013, pp.237-252. ISSN: 2146-4138. [21]. Prentice D and Holand P, Contemporary Issues in Corporate Governance (1993). Contemporary Issues in Corporate Governance. I SBN-13: 978-0198258599 [22]. Nicolae Petriaa , Bogdan Caprarub , Iulian Ihnatovc (2015). Determinants of banks’ profitability: evidence from EU 27 banking systems. Procedia Economics and Finance 20 ( 2015 ) 518 – 524. [23]. Nguyễn Thị Diễm Hiền và Nguyễn Hồng Hạt (2016). Thu nhập ngoài lãi và hiệu quả tài chính tại các ngân hàng thương mại Việt Nam, Tạp chí công nghệ ngân hàng, số 127 [24]. Sinha (2008). Ownership and Efficiency: A Non-Radial Bilateral Performance Comparison of Indian Commercial Banks. The Icfai University Journal of Managerial Economics, Vol. VI, No. 4, 67-81, 2008. [25]. Spatareanu et al. (2005), Do Foreign Investors Care about Labor Market Regulations? Review of World Economics (Weltwirtschaftliches Archiv), 2005, vol. 141, issue 3, 375-403 [26]. Sherdan T and Kendall N, Corporate Governance: An Action Plan for Profitability and Business Success (1992), 12 [27]. Yasuhiro Yamada (2017). Foreign Direct Investment in Asia. http://www.nhandan. com.vn/kinhte/item/ 32983202- tao-co-hoi- thu-hut-dau-tu-nuoc-ngoai-vao-khu-vuc-chau-a.html [28]. Tandelilin et al. (2007). Corporate governance, risk management and bank performance: Does Type of Ownership matter? EADN Working Paper No. 34. [29]. Trần Huy Hoàng và Nguyễn Hữu Huân (2016). Phân tích các yếu tố tác động đến hiệu quả hoạt động của hệ thống ngân hàng thương mại Việt Nam trong thời kỳ hội nhập tài chính quốc tế. Tạp chí phát triển KH & CN, tập 19, số q1 – 2016