|

Nitin Bansal Research Scholar Banasthali Vidhyapith, Jaipur, India Contact No.:- +91-7055890989 E-mail:- bansal.nitin@rediffmail.com |

Government of India has demonetized the currency of Rs.500 and Rs.1000 on 8 th November 2016, aimed to address corruption, counterfeit currency, black money and terror financing. The total value of demonetized currency was Rs. 15.4 trillion, which constituted around 86.9% of total currency in circulation. The study conducted in this paper reveals that demonetization influenced various economic sectors differently. The highly impacted period due to demonetization was experienced especially during November and December 2016. This impact was moderated prominently in the month of January 2017 and immoderate to a longer extent by mid of February 2017. As an impact of demonetization on Indian banks, there is a positive change in the financial statements of scheduled commercial banks. The quantum of amount deposited in the banks has raised and created surplus liquidity conditions. A significant increase in total number of accounts opened under the scheme of Pradhan Mantri Jan Dhan Yogna and the amount deposits in these accounts have also increased. A significant impact of demonetization has also been monitored in the use of electronic banking transactions. This study is descriptive in nature and the data has been taken for the period of pre-demonetization and post-demonetization.

Keywords: Demonetization, Banks, Liquidity, Digitalization, PMJDY, Currency in circulation.

Kumar and Kumar (2016) stated that on 8th November 2016, Indian government has withdrawn the currency of Rs. 500 and Rs. 1000 notes from the circulation and declared this currency would not be a legal tender now onwards. The total value of such notes was Rs. 15.40 trillion, which constituted 86.9 percent of the total value of currency in circulation. Preethi and Sangeetha (2017) mentioned that the government was in continuation of a series of measures taken during last two years to eliminate black money, corruption, counterfeit currency, terror funding, and to help the Indian economy by greater digitization, increased flow of financial savings, higher GDP and tax avenues. India is a cash intensive economy. According to the report of the committee on Digital Payments in 2016 which was chaired by Mr. Ratan Watal, in India 78% of all consumer payments are affected in cash and only 22% of all consumer payments are affected through digital mode either through net banking, cheque transaction and others. As per the report available in July 2010 provided by World Bank , India had the shadow economy of 20.7% of its GDP in year 1999 and it increased up to 23.2% of Gross domestic Product in 2007.

According to Singh and Singh (2016) demonetization means termination of an agreement which means to withdraw the particular currency from the economy which was in circulation earlier. Digitization means to offer the products and services through electric channels of bank with the help of internet. Negi and Pant (2017) stated that banking is a service industry and now a day banks are catering to the services at the finger tips of customers. One of the most influenced sector from demonetization was banking industry and it made vibrations in the operations as well as products and services of banks. Tharoor (2016) mentioned that demonetization created higher demand to digital banking services in which cashless transactions are prioritized. Digitization made significant influence on management of liquidity and its demand raised by customers in the exchange of their demonetized currency notes. Most of the banking operations were disturbed during the period of demonetization and the bank employees have worked under unconditional stress in extended working hours . Sinha and Rai (2016) stated that during demonetization period there was an inflow of huge quantum of funds being deposited and exchanged in bank branch, increase in the number of foot falls in bank branch, significant increase in the banking activities and increase in the volume of number of transactions through banks and on the other hand demonetization also created multiple problems for the customers as well as for employees.

Shukla (2017) stated that government of India had permitted to circulate the demonetized currency for purchase of railway tickets, purchase of petroleum products, purchase of medicines and payments of hospital bills, purchase of milk at milk booths and at state and central government authorized consumer cooperative stores. Bansal and Singh (2018) stated that various determinants of automatic teller machine have played a prominent role in digital banking. These determinants have a significant impact on the customer satisfaction. Ramdurg and Basavaraj (2016) mentioned about the currency in circulation which plays a very prominent role to take the decision of demonetization. On 6th November 2016, the currency in circulation was 17.99 Lakh crore. Currency in circulation refers to the total currency available in market except currency available with Reserve Bank and currency chests.

This study is an attempt to assess and evaluate the effects of demonetization on banks liquidity and digitization.

Rastogi (2018) studied the reasons of demonetization in India and evaluated its impact on black money, fake currency, terror financing, note bank politics, economic growth of India, cashless economy and stock market for pre and post demonetization period and asserted that demonetization decision was taken on right time as economy was performing well and could absorb the short term shocks.

Sarkodie (2018) examined the effect of demonetization on labour class of Lovely Professional University and depicted the various reasons of failure of demonetization. It is mentioned that demonetization was a great step but it could not eradicate black money and having negative impact on poor class people.

Bansal and Jain (2018) examined the significant changes in the utilization of digital banking services in India after demonetization using paired sample T test and revealed that the usage of digital banking services in both the terms i.e. volume wise and value wise has been increased after demonetization.

According to Kaur (2017) cashless payment system in the economy has multiple benefits i.e. time saving, minimization of cost, green banking and many more. In this study the future of all the transactions throughout the country is expected through cashles transaction system only.

Singh and Singh (2016) described that demonetization was like a surgical strike on black money and in first 3 days Rs. 35,000 crores deposited in banks and around Rs. 1500 crores black money were destroyed.

Rao et. al., (2016) studied the impact of demonetization on the basis of demand for cash by various agents in economy. There are four types of transactions which are unaccounted transactions, illegal transactions, informal sector transactions, and accounted transactions. The effect of demonetization was on all these transactions.

Pulla (2016) discussed about the digitalization of Indian economy. He discussed various projects taken by government of India like Digital India, Bharat Net, DigiGaon. It is stated in the study that digitalization reduces the tax evasion and enhance the tax revenue to the government.

Paramahansa and Eliot (2017) portrayed the long term advantages and short term cost of demonetization. This study reveals the advantages as well as adverse effect of cashless economy. Besides this the effect on circulation of currency, gross domestic product, black money, corruption and taxation were highlighted.

Uke (2017) researched on demonetization and its effects in India and studied supportive and adverse impact of demonetization in India. The prime objective of demonetization was to eradicate the black money and diminish the corruption. In this act, government of India has become success to some extent and the real positive impact will be in front of all in future.

According to Singhal (2017) in research on demonetization and E Banking in India. In this study it revealed that urban male youth have higher awareness about electronic banking services even prior to demonetization and after demonetization the proportion of the customers using electronic banking services has been increased substantially.

According to Gajjar (2016) in her study on black money in India described the policy options, strategies and framework that should be adapted by Indian government to tackle the issue of black money and various future challenges to be faced by government.

According to Nithin and Sharmila (2016), demonetization has short term adverse impact on various sectors of Indian economy and such impact are solved with the availability of new currency notes widely circulated in the economy. This study also argued that the Indian government should solve all the issues created because of demonetization and help the economy to work in a smooth way.

Antony and Maheshwari (2017) examined the demonetization and its financial inclusion in all aspects. The study reveals that the rewards of demonetization are encouraging and the outcomes are in the interest of the country in long run. It influenced the banking industries to invest on the digitization of all banking services.

Chatterjee and Banerji (2016) discussed about the short term liquidity problem in Indian economy and substantial increase in the deposits in banks due to demonetization. The study reveals that spending patterns and consumption trends in the Indian economy changed in the short period of time and people changed their attitude to use alternate channels of payment for purchasing.

Objectives of The Study

. To analyze the impact of demonetization on the financial statements (balance sheet) of Scheduled commercial banks in India.

. To study the deposits trend under Pradhan Mantri Jan Dhan Yojna accounts.

. To study the positive and negative outcomes of demonetization on banking operations.

. To assess the impact of demonetization on the liquidity position of Scheduled commercial banks.

. To evaluate the impact of demonetization on currency in circulation and GDP ratio.

This research paper is based on secondary sources of data. The used data has been taken from authenticated sources such as books, journals, RBI website and relevant government websites. The research is descriptive in nature. The period of the study is from November 2016 to March 2017.

Data analysis and interpretation

Balance sheet effects of scheduled commercial banks: As an effect of demonetization, there was a decline in currency in circulation led to an upswing in the bank deposits. The demonetized currency was taken by banks at bank counters till December, 30th 2016. There was an acute decline in the circulated currency by about Rs. 8800 billion between 28 th October 2016 and 6th January 2017 (i.e. days exactly prior to and later demonetization for which banks usually provides fortnightly data). As a result it majorly enhanced about Rs. 6720 billion in aggregate deposits of the banking system.

During this period re-monetization has shown a significant progress at a faster pace. Beginning with the last week of December 2016 to the first week of March 2017, a positive change in the circulated currency to the extent of Rs. 2600 billion has been reported. During this time period there was a moderate decline in deposits with banks.

Usually bank provides the data of its prominent assets and liabilities on fortnightly basis. According to the data provided by banks for the period of 28th October 2016 (pre demonetization) and 17th January 2017, the total deposits of scheduled commercial banks have enhanced by Rs. 5549 billion during this period.

Table 1: Variations in prominent assets and liabilities of Scheduled Commercial Banks (28th October 2016 to 17th January 2017)

(Rs. Billion)

|

Liabilities |

Amount |

Assets |

Amount |

|

Total deposits Borrowings |

5,549 -56 |

Bank credit Investment in Govt. Securities Net other assets |

1,008 4,560 -75 |

|

Total |

5,493 |

Total |

5,493 |

Source: RBI website

Bulk of the money deposited in banks were deployed in (a) reverse repo of various tenors with the reserve bank of India; (b) Investment in government securities by issued cash management bills; (c) Loans and advances given by banks increased by Rs. 1,008 billion. During this period the incremental credit deposit ratio(ICDR) was only 18.2%.

Liquidity concerns

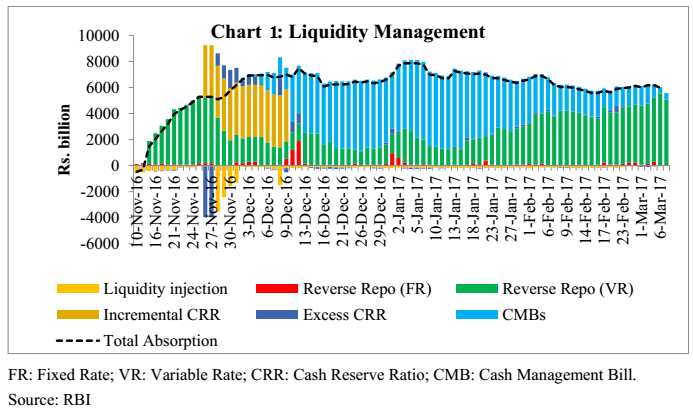

With the announcement of demonetization, bank customers returned specified bank notes (SBN) to the banks (i.e. Rs. 500 and Rs. 1000 notes). This surprise step increased the quantum of deposits enhanced surplus liquidity concerns in the banking sector. The Reserve Bank of India has managed the excess liquidity concerns in 4 phases as mentioned in chart 1.

(a) First phase from 10th November 2016 to 25th November 2016: The RBI applied liquidity adjustment facility through changing reverse repos of different time periods ranging from 15 days to 91 days and adjusted excess liquidity of banks.

(b) Second phase from 26th November 2016 to 9th December 2016: The excess liquidity was absorbed with the variable reverse repos and the incremental cash reserve ratio of 100% on the increase in net demand and time liabilities from 16th September to 11 th November 2016. It helped to drain about Rs. 4,000 billion excess liquidity during the fortnight ended 9th December 2016.

(c) Third phase from 10th December 2016 to 13th January 2017: The excess liquidity was managed with the mix of various reverse repos and by issuance of cash management bills through an enhancement of the limit from Rs. 300 billion to Rs. 6,000 billion on 2 nd December 2016 by the Indian government. The maximum surplus was managed on 4th January 2017 of Rs. 7,956 billion, out of which Rs. 2,568 billion managed by reverse repos and Rs. 5,466 billion through cash management bills.

(d) Fourth phase from 14th January 2017: The surplus liquidity was managed by mix of reverse repo operations, specially the liquidity released through the maturing cash management bills.

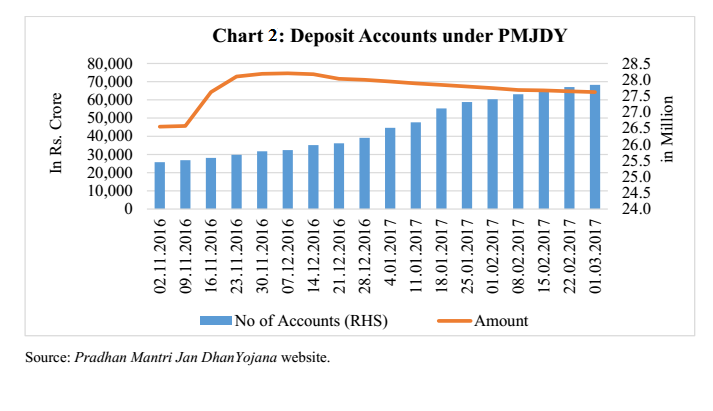

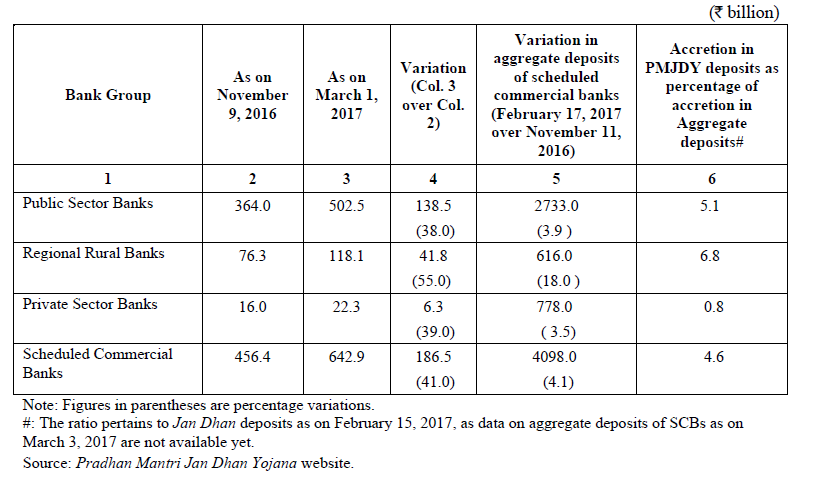

The government also instructed to deposit maximum amount of Rs. 50,000 in Pradhan Mantri Jan Dhan Yojna accounts on 15th November 2016. On 1st March 2017, although the balances declined to Rs. 643 billion but still were 41% higher as on 9th November 2016. The accounts opened under PMJDY contributed 4.6% in total accumulation of aggregate deposits of scheduled commercial banks in the period of post demonetization.

Table 2: Amount deposits in PMJDY: Number of Accounts (in million)

|

Bank Group |

As on 9th November 2016 |

As on 1st March 2017 |

Variation (1.3.17 over 9.11.16) |

||||||

|

Rural |

Urban |

Total |

Rural |

Urban |

Total |

Rural |

Urban |

Total |

|

|

Public sector banks |

114 |

89.3 |

203.6 |

122 |

100.8 |

223 |

7.8 |

11.5 |

19.3 |

|

(6.8) |

(12.9) |

(9.5) |

|||||||

|

Regional rural banks |

37.1 |

6 |

43.1 |

40 |

6.4 |

46.4 |

2.9 |

0.4 |

3.3 |

|

(7.8) |

(6.8) |

(7.7) |

|||||||

|

Private sector banks |

5.3 |

3.1 |

8.4 |

5.4 |

3.6 |

9 |

0.1 |

0.5 |

0.6 |

|

(1.3) |

(16.8) |

(7) |

|||||||

|

Scheduled commercial banks |

157 |

98.4 |

255.1 |

168 |

110.9 |

278 |

10.8 |

12.5 |

23.3 |

|

(6.9) |

(12.7) |

(9.1) |

|||||||

Note: Figures in parentheses are percentage variations.

Source: Website of Pradhan Mantri Jan Dhan Yojna

Table 3: Deposits Under PMJDY : Amount Mobilised

Currency in circulation (CIC) and GDP

India was facing an issue of high CIC in comparison to Gross domestic product of the country as CIC reached upto the level of Rs.17.977 lakh crore as on 4th November 2016, even it was Rs.13.715 lakh crore as on 23rd May 2014. After demonetization it has been monitored that CIC has touched Rs. 8980.17 lakh crore as on 6th January 2017. In the financial year 2016-17 CIC to GDP ratio has been reported as 8.8% which is quite low in comparison with the financial year 2015-16 when the ratio was 12.20%.

Source: Reserve Bank of India website

Source: Reserve Bank of India website

The demonetization of the currency (Rs. 500 and Rs. 1000 notes) on 8 th November 2016 was one of the step taken by government of India. This decision way fetch positive results in the long term. This study concluded that the step of demonetization improved the liquidity position of the scheduled commercial banks in India and banks invested the excess amount in various investment opportunities which helped the banking sector to increase their profitability position. It is also concluded that the objective to open the Pradhan Mantri Jan Dhan Yojna Account has been realized and people used PMJDY accounts during demonetization period which will change the attitude of the customers to use physical currency and customers will shift to digital banking services which will again be helpful for the banking sector as well as customers. Study also suggests that the step will help the banking industry to maintain adequate liquidity, minimization of non performing assets, optimization of electronic banking services which will reduce the cost of products and services of banks and enhance the profitability of banking sector. This move will also help to reduce fiscal deficit, control on inflation, lower corruption, improved tax compliance, elimination of counterfeit currency and sustainable economic growth in long run. In the “post demonetization” era the currency in circulation is lower than pre demonetization period. Experts are of the opinion that demonetization has helped to reduce the circulation of black money to certain extent.

Antony, J. P., & Maheshwari, D. K. (2017). Impact of Demonetisation on Banks. International Education and Research Journal , 3 (5).

Bansal, N., & Jain, M. (2018). Progress in Digital Banking After Demonetization: Some Evidence. IUP Journal of Bank Management , 17 (2), 50-59.

Bansal, N., & Singh, K. (2018). The Impact of Determinants of Service Quality of Automated Teller Machines on Customer Satisfaction . IPE Journal of Management , 8 (2), 54-66.

Kaur, M. (2017). Demonetization: Impact on Cashless payment system. International Conference on Recent Trends in Engineering, Science and Management. ISBN:978-93-86171-21-4. 8th January, 2017.

Kumar, S. V., & Kumar, T. S. (2016). Demonetization and Complete Financial Inclusion. International Journal of Management Research and Reviews , 6 (12), 1703.

Negi, A., and Pant, R. (2017). Demonetization: A Harrowing Nightmare or a Dawn of a New Era. Journal of Exclusive Management Science , 6(6).

Nithin, K. A. & Sharmila (2016). Demonetization and Its Impact on Indian Economy. International Journal of Humanities, Arts, Medicine and Science. ISSN (P) , 2348-0521.

Paramahamsa, R., & Eliot, G. (2017). Demonetisation: To Deify or Demonize? Economic Survey 2016-17.

Preethi, S., & Sangeetha, V. M. (2017). Impact of Demonetization on Indian Economy. International Journal of Research in Economics and Social Sciences (IJRESS) , 7 (3), 20-28.

Ramdurg, A. I., & Basavaraj, D. (2016). Demonetization: Redefining Indian economy. International journal of commerce and management research , 2 (12), 07-12.

Rao, K., Mukherjee, D. S., Kumar, D. S., Sengupta, D. P., Tandon, S., & Nayudu, S. H. (2016). Demonetisation: Impact on the Economy. NIPFP Working , 182 , 1-17.

Rastogi, H. (2018). Demonetization and its impact on Indian economy. International Journal of Academic Research and Development , 3 (1).

Sarkodie, E. (2018). Demonetization and the poor strata of society. International Journal of Advanced Research and Development , 3 (1).

Singh, P., & Singh, V. (2016). Impact of demonetization on Indian economy. International journal of science technology and management , 5 (12), 625-635.

Singhal, S. (2017). Demonetisation and E-banking in India. International Journal of New Technology and Research (IJNTR) 3(1), 20-25.

Sinha, A., & Rai, D. (2016). Aftermath of demonetization on rural population. International Journal of Research in Economics and Social Sciences (IJRESS) , 6 (11), 223-228.

Tharoor, S. (2016). India’s Demonetization Disaster. Journal of International Relations and Sustainable Development , 9(9).

Uke, L. (2017). Demonetization and its effects in India. SSRG International Journal of Economics and Management Studies , 4 (2), 18-23.

Weblinks

Chatterjee, B., & Banerji, A. (2016, December 26). Squire Patton Boggs. Retrieved from http://www.squirepattonboggs.com/~/media/files/insights/publications/2016/11/the-impact-ofindias-demonetization/252122020the20impact20of20indiac2b9s20demonetization20alert.pdf

ENS Economic Bureau. (2016, December 29). Demonetisation impact: RBI eases small loan repayment norms. Retrieved from https://indianexpress.com/article/business/banking-and-finance/demonetisation-impact-rbi-eases-small-loan-repayment-norms-4449416/

Gajjar, N. (2016). Black Money in India: Present Status and Future Challenges and Demonetization. International Journal of Advance Research in Computer Science and Management Studies , 4 (12).

HDFC Bank Investment Advisory Group. (2016, November 11). Demonetization and its impact Event Update. Retrieved from https://www.hdfcbank.com/assets/pdf/Event_Update_Demonetization_and_its_impact.pdf

Pulla, V. R. (2016, November 20). Unprecedented Move: The Demonetisation of some currency notes in India. Retrieved from ResearchGate: https://www.researchgate.net/publication/310458037_Unprecedented_Move_The_Demonetisation_of_s ome_currency_notes_in_India

Reserve Bank of India. (2017, March 10). Macroeconomic Impact of Demonetisation - A Preliminary Assessment. Retrieved from https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/MID10031760E85BDAFEFD497193995BB1B6DBE602.PDF

Shukla, S. (2017, February 14). Demonetisation puts brakes on banks’ loan recovery efforts. Retrieved from http://economictimes.indiatimes.com/industry/banking/finance/banking/demonetisation-puts-brakes-on-banks-loan-recovery-efforts/printarticle/57135362.cms