|

Sobia Naseem Department of Optimization and Decision Making Liaoning Technical University, Liaoning, China E-mail:- Sobiasalamat4@gmail.com |

Gao Lei Fu Department of Optimization and Decision Making Liaoning Technical University, Liaoning, China E-mail:- gaoleifu@163.com |

Vu ThiLan Department of Optimization and Decision Making Liaoning Technical University, Liaoning, China E-mail:- lanvu90@163.com |

Muhammad Mohsin College of Business Administration Liaoning Technical University, China E-mail:- mohsinlatifntu@gmail.com |

Muhammad Zia-Ur-Rehman Department of Management Science National Textile University, Pakistan E-mail:- zia.msfin@iiu.edu.pk |

The motivation behind this study is to an empirical examination of relationship exist between the stock value (KSE-100 index) and macroeconomic factors (Money supply, Inflation Rate, Interest Rate, and Exchange Rate) by utilizing monthly time series data information covering the period 30th June2009- 30th June 2018. The main target of this investigation is to check the long-run and short-run connection between macroeconomic factors and stock cost by using the different strategies and procedures. The outcomes of Augmented Dickey-Fuller (ADF) and Phillips Perron (PP) unit root test indicated the primary series is non-stationary in level and stationary in the first difference. On a monthly basis by using the Johann-Juselius (1990) multivariate co-integration and Vector Error Correction Model techniques, it is indicated the Pakistani stock market had a long run equilibrium relationship with a set of macroeconomic variables and with the short-term dis-equilibrium corrected at 7.22%.These discoveries are valuable for policymakers; securities exchange controllers, financial specialists, and stock exchange examiners.

Keywords: Stock Prices, Macroeconomic variables, Co-integration, VECM.

The stock market has been truly analyzed as an unswerving component to show the financial procedures of the nation. The imperative job of an effectual financial system is to utilize the capital resources meritoriously and proficiently (Ahuja et al., 2012). Be that as it may, existing examination uncovers the logomachies of the matter. The reasonable indulgent of stock & securities exchange determining factor is crucial for financial specialists, controllers, and researchers (Donatas Pilinkus, 2009). Because Mukit (2012) investigated that borrowers request assets from a similar framework with the possibility that they will be obligatory to reimburse the entirety with the financing cost in future. Karachi Stock Exchange (KSE) is the greatest Exchange floor of Asia and greatest one of Pakistan Stock Exchange (PSX). Stock prices are emphatically prejudiced by a set of macroeconomic factors like as Inflation, Gross Domestic Prices and Exchange Rate as well as adversely influenced by Interest Rate (Khan, 2014). Securities are exchanged the optional funds & securities exchange. Security is fundamentally a trade of reserve. The exploration of (Adam et al., 2008) inferred that change in macroeconomic factors is lead to change the structure of stock trade.

Skillet et al., (2007) Inflation, Interest and Exchange rate are driving variables which turned into a reason for the change in stock costs. Inflation and stock costs are adversely identified with one another in the Tokyo stock trade (TSE) as indicated by Roll and Gaske (1983) and Rose, Chen, and Rall (1986). Park (1997's) and (Achsani&Strohe, 2002)examine explores that stock returns are exceptionally contrarily impacted by work development and emphatically influenced with GDP. Development exercises decline a nation’s inflation rateso because of a declining in the expansion rate securities exchange is decidedly influenced. Inflation rate and stock cost are randomly identified with one another (Fama&Schwert, 1977; Schwer at al., 1981). Money related approach is connected with stock prices such as Mukit (2012) by applying the co-integration technique, he concluded that if 1% of changes occur in interest rate and exchange rate so stock price affected 1.71% and 1.04% respectively. A long run relationship is observed between macroeconomic variables and changes in stock prices (Fama, 1981, 1990).

The study of(Muhammad & Shahid, 2008)also concluded that short-run interest rate and money supply are positively related with stock exchange and negative foreign exchange reserve & inflation while this relationship changed into opposite when short-runperiodchanges into the long-run period. In accordance with the study of Heinz Herrmann et al., (2006) that Currency depreciation is converted into an origin of declining in stock prices for a short run. Ajayi and Mougoue (1996) inspected in their examination stock price negatively affects the estimation of domestic currency for short-run time range while in the long run, this connection varies into a positive relationship.

The monetary system unequivocally influenced the economic development of Pakistan (Sara & Levine, 1996). The interpretations of Sara and Levine (1996)’s research consist of the positive relation exploration amid economic growth and stock because of predestined factors. Assimilation of the (Habib, 1996) inquired a positive connection of money supply and stock return in short-run anyway it may change if there ought to emerge an event of long-run. Aforementioned financial reforms, stock prices, exchange rate and foreign reserve are positively related to one another (Muhammad, 2009).

Stock prices negatively related to inflation and call money (Achsani & Strohe, 2002)whereas a positive influenced via money supply, exchange rate, and gross domestic product. Chaudhuri & Smiles (2004) described a long run relationship between stock prices and variations of macroeconomic variables (oil prices, money, private consumption & GDP) by using Australian stock market’s data for the time of 1960 to 1998.

By using Granger non-causality (Azman-Saini & Habibullah Law et al ., 2006) wrapped up that depreciation of Malaysian Ringgit significantly influenced Malaysian stock market in the crisis era.The examination of Zhang at al., (2006) also provides corroborating evidence about short and long-run relation between a meticulous set of macroeconomic variables stock market of New Zealand. Money supply and inflation rate depict a negative impact by the Granger causality test. When interest rate increase as juxtaposing to other countries foreign investors deposit their money instead of risky investment and in case of low-interest rate people invest their money in a stock market that’s why the impact of the money supply is always negative in New Zealand. Patra and Poshakwale (2006) concurred that Athens stock market significantly affected by macroeconomic variables (inflation, money supply, and trading activity) for curtail span of time with the unanimity of Granger causality test and no short or long-run equilibrium state observed in stock prices andexchange rate. Athens stock exchange is inefficient that openly existing data on macroeconomic factors and exchanging size can be conceivably utilized in imagining stock prices (Khan et al., 2013).

Inflation and unemployment are highly significant with a negative impact on stock prices (Martin Sirucek, 2012). By using multiple regressions analysis with chronological monthly data (MACN Shafana, 2012) observed Sri Lankan stock exchange positively affected by inflation rate and negatively significant with exchange rate for (January 2008-2012) four years informational data. Treasury bill imperceptibly negatively influenced all sectors of share prices. Sharma & Mahendru (2010) investigated exchange rate and gold prices have a long-run relationship with stock prices as well as both factors highly affected the stock market by using Indian stock market data from January 2008 to January 2009. According to Krishna Reddy (2015)’s investigation most of empirical analysis are favored the inconsistency of long and short-run relationship among stock market and particular set of macroeconomic variables (Muneer et al., 2017).

Uncommon and motivating research by Mustafa (2007), investigated an ostentatious relationship of stock market and development of a country are directly connected with the help of co-integration model. A momentous relation is observed between the exchange rate, oil prices and stock market index of BRIC(Robert, 2008). A causal relationship perceived in macroeconomic determining factors and stock prices thorough Johansen‘s approach of co-integration (Ahmed, 2008). Pakistani stock market is based on speculation not on the true fundamentals. Macroeconomic variables significantly affect the Kuala Lumpur Composite Index (KLCI) analyzed by the impulse response function, Co-integration test, ECM, variance corrosion & the unit root test. Furthermore suggested to Malaysian government have to be emphasized on policies and strategic management for stabilization of stock market (Mohamed et al., 2010).

Maysami and Koh (2000) found that money supply and stock return are positively related to each other. Achsani and Strohe (2002) found stock return negatively respond to interest rate and positively respond to oil price and real economic activity in small regional markets like as Norway (net oil exporting country) and Indonesia. By applying some specific test carefully like as Unit Root Test of Ng, Perron to test for time series properties, Dickey-Fuller and Philips-Perron and Johansen co-integration test than concluded that all macroeconomic variables except money supply initially linked negatively with the stock market (Guneratne & Wickremasinghe, 2006).

Pal and Mittal (2011) concluded macroeconomic variables have a substantial impact on the stock return of India by using the pre and post-crises data of the stock market. Pakistani stock market is an accurate prognosticator of economic activity of country (Kamran &Israr, 2015). Thisarticle will also verify the relationship of stock prices and macroeconomic variables, by using a set of data from Pakistani economy and its major stock exchange ,i.e., Karachi Stock Exchange. This study enriched the available stock of literature and boost up the present research for better development of Pakistan stock market.

H 1 = A stable significant long-run relationship exist between macroeconomic variables (M2, IFR, INR & EXR) and stock prices

H 2 = A stable significant short-run relationship exist between macroeconomic variables (M2, IFR,INR& EXR) and stock prices

Karachi Stock Exchange (KSE 100 index)

The focus of this study is observed the nature of relationship, either long or short-run; between macroeconomic variables and stock prices by applying monthly data over the period of 30th June2009- 30th June 2018 Pakistan stock market (KSE) is as old as Pakistan. Karachi stock exchange founded 14 August 1947 and established 18 September 1947 with five companies as KSE-50 with a total market capitalization of US $350,000 (37 million PK rupees). The KSE promoted capital formation and facilitated a wide range of participants (individual and institutional investors) for the last 70 years. With growing numbers of listed companies and trading activities, the KSE 100 index (included banking, processing plant, pharmacological, cement, E & P, and so on) was introducedin November 1991. On 20 April 2008 Pakistani stock exchange achieved 15,737 points for the first time it was 7.4% increase made Pakistan stock exchange had become the high pointe achievers among the rest of emerging world markets. In rest of 2008 stock market was influenced by inflation, attack of investors at KSE building, Taliban and resignation of President Pervez Musharraf. In 2009 PSX has recovered all negligence of 2008 and again become the third best performer stock market of the world. Pakistan delivered 26% equities for US dollars in 2015 and maintained the position of the best performer stock market of the world. In 2016 stock market showed an upward trend, so investors became confident to invest in Pakistan stock exchange (PSX). The year 2017-18 show a mixed performance in volatility perspective.

Source of data and description

This study is based on pragmatic research on secondary data. Previous work on this topic also supports that macroeconomic variables and stock market having a relationship with each other, after consulting and studying the literature as well as reviewing the Pakistani economy it’s considered that four macroeconomic variables are important to check the relationship with stock prices. Monthly time-series data is usedfrom 30th June2009- 30th June 2018. The current data of KSE 100 index from 30th June2009- 30th June 2018is used in this study which collected from the Karachi Stock Exchange, Pakistan. Major sources of macroeconomic variables’ data are IMF, Statistics Bureau, Index Mundi, Business Recorder, State Bank of Pakistan and Yahoo Finance. Following Table shows the variables with their description.

|

Variables and their Description |

||

|

Variable |

Description |

Unit |

|

KSE |

Karachi Stock Exchange 100 Index |

|

|

M2 |

Broad Money Supply |

Rs. In Million |

|

IF |

Consumer Price Index (CPI) |

Percent |

|

IN |

Weighted average 91 days T-Bill rate, Annualized |

Percent |

|

EX |

Monthly Exchange rate Pak Rupee against US Dollar |

Rupees |

Methodology

To analyze the coessentiality of relationship, either short or long-run relationship exists among the macro economical variables’ set and stock prices in Pakistan by using Johansen multivariate co-integration test and Granger-causality. The specific models are given below:

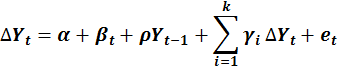

Unit root test

Spurious regression problem may be found when regression is running on non- stationary variables. The non-stationarity of data eliminated by using the Unit root test and converted it in stationary time series. There is many unit root test one of the most well-liked is the Augmented Dickey-Fuller (ADF) test. The ADF test (1979, 1981) requires variable regressing the first difference on its lagged level.

H0 =Yt is not stationary

H1 =Yt has stationary

In this equation represent selected variables’ time period, difference operator, time trend, error term with 0 mean and variance and number of lags for difference respectively.

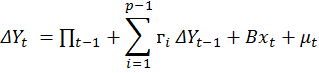

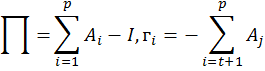

Co-integration test:

Mostly Macroeconomic variables have non-stationarity with time-dependent mean and variance. Variables’ Linear Combination indicates the stationarity of series data. This linear relationship is called a co-integrating equation and show the long-run equilibrium relationship with variables. An assortment of approaches has been used to found co-integration, like as, Engle-Granger method (Engle and Granger, 1987), dynamic OLS (Wasten, 1993), Bound test (Pesaran et a., 2001) and Johansen-Juselius method (Johansen-Juselius 1990).In this study use the Johansen-Juselius method to examine co-integration.

H0 = there is no co-integration

H1 = there is integration

The matrix discloses the adjustment in accordance with disequilibrium. The rank of proportionate the quantities of its attributes root that different from zero which thus compares to the quantity of co-mix numbers. The component of or stacking coefficient and given the speed of change of endogenous factors in counter to disequilibrium stuns matrix capture the short term dynamics adjustments. The test proceeds rely on the association with the position of a matrix and its characteristics roots.

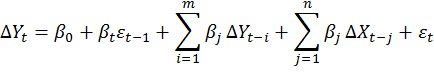

Vector Error Correction Model

An error correction model which also known as co-integration model is a type of multiple time series model and used when data core variables have a long-run random trend. The short-run relationship between the stock return, macroeconomic variables and adjustment speed toward the long-run equilibrium level is observed by VECM estimation. The VECM equation is:

The lags error correction term represents by attain from the co-integration equation. It captured the short to long-run equilibrium’s adjustment rapidity.

Empirical Findings

The skewness value of all crypto currencies is negative which indicate a long left tail, and the excess kurtosis value from 3 shows the leptokurtic behavior. The Jarque-Bera (JB) [i] test is significant at 1% level, so the statistics value of JB depicts departure from the normality as (Miron& Tudor, 2010; Katsiampa, 2017; Ané, 2006; Drachal, 2017). ARCH (5) test for conditional heteroscedasticity rejected the null hypothesis and confirmed the occurrence of ARCH affect in returns of crypto currencies which indicates that the GARCH techniques can perform with different specifications (Diebold, 2004; Omolo, 2014).

Table-1 shows that the results of descriptive statistics of all variables the daily average return KSE (9.748), M2 (15.815), IFR (-2.415), INR (-2.299) and EXR (4.512) with positive standard deviavtion. Skewness value of KSE and M2 is positive with long right tail and negative in IFR, INR & EXR which indicate long left tail. Value of Kurtosis lie between 0-3 in all variables except EXR, it’s an indication toward platykurtic behavior and normal distribution. The Kurtosis of EX was larger than 3 which mean the values contemplate around its mean and rest of variables are normally distributed.

|

Table 1 Descriptive Statistics |

||||||

|

Variables |

KSE |

M2 |

IFR |

INR |

EXR |

|

|

Mean |

9.748 |

15.815 |

-2.415 |

-2.299 |

4.512 |

|

|

Median |

9.633 |

15.820 |

-2.268 |

-2.307 |

4.546 |

|

|

Maximum |

10.795 |

16.374 |

-1.373 |

-1.977 |

4.677 |

|

|

Minimum |

8.590 |

15.304 |

-4.328 |

-2.717 |

4.133 |

|

|

Standard Deviation |

0.572 |

0.328 |

0.649 |

0.242 |

0.132 |

|

|

Sk. |

0.049 |

0.015 |

-0.896 |

-0.616 |

-0.932 |

|

|

Kur. |

1.765 |

1.707 |

2.389 |

2.135 |

3.127 |

|

|

Observations |

108 |

108 |

108 |

108 |

108 |

|

SourcesEviews 8.

Table 2 presented the results of Augmented Dickey-Fuller (ADF) and The Phillips Perron (PP) unit root test. The ADF test results prognosticate that only the lag Schwarz info Criterion (SC) in level does not reject the H0 of non-stationary which means that all variables in level are unit root but after taking the first difference rejected at the level of 1% and 5% of significance level. By using this test, the stock market and macroeconomic variables are shown non-stationary behavior in level and series become stationary after first difference. The Phillips Perron Root Test (PP) also presents the results which ADF test is shown: all macroeconomic variables and KSE 100 index having non-stationarity when the test in levels and after first difference shows stationarity in variables which pointed toward the long-run relationship as (Christopher Gan et al., 2006).

|

Table 2 (a): ADF & PP (without first difference) |

|||||||

|

Constant |

|||||||

|

Variables |

ADF test |

PP test |

H0 |

Results |

|||

|

t-Statistic |

t-Statistic |

Fail to reject Ho |

nonstationary |

||||

|

KSE |

0.575 |

0.462 |

Fail to reject Ho |

non stationary |

|||

|

EX |

-3.452 |

-3.620 |

Fail to reject Ho |

non stationary |

|||

|

IF |

-1.163 |

-1.144 |

Fail to reject Ho |

non stationary |

|||

|

IN |

0.046 |

-0.463 |

Fail to reject Ho |

non stationary |

|||

|

M2 |

0.179 |

-0.860 |

Fail to reject Ho |

non stationary |

|||

|

(b) ADF & PP (with first difference) |

|||||||

|

Constant |

|||||||

|

Variables |

ADF test |

PP test |

H0 |

Results |

|||

|

t-Statistic |

t-Statistic |

Reject Ho |

Stationary |

||||

|

KSE |

-8.929 |

-8.933 |

Reject Ho |

Stationary |

|||

|

EX |

-6.668 |

-6.612 |

Reject Ho |

Stationary |

|||

|

IF |

-8.694 |

-9.556 |

Reject Ho |

Stationary |

|||

|

IN |

-7.573 |

-7.584 |

Reject Ho |

Stationary |

|||

|

M2 |

-10.020 |

-37.272 |

Reject Ho |

Stationary |

|||

Note: H0 is not rejected if test statistics < critical value and rejected if test statistics > critical value.

*5% level of significance, indicate acceptance of the null hypothesis of the variable is not stationary .

Before applying co-integration technique, an adequate lag length has chosen. The study applies lag order selection based on LR test statistics and information criteria. The results recommended different lags like as LR test statistics, Final Prediction Error (FPE) and Akaike Information Criterion (AIC) suggest lag 5, Schwarz Information Criterion (SIC) suggests lag 1 and Hunnan-Quinn (HQ) imply lag 3.The accuracy of co-integration is 5 lag which shown by VAR lag order selection criterions.

|

Table 3 Lag Selection Criteriausing VAR |

|||||||

|

Lag |

LogL |

LR |

FPE |

AIC |

SC |

HQ |

|

|

0 |

279.301 |

NA |

3.35E-09 |

-5.326234 |

-5.198334 |

-5.27443 |

|

|

1 |

834.2789 |

1045.298 |

1.14E-13 |

-15.61707 |

-14.84967* |

-15.30624 |

|

|

2 |

874.8428 |

72.46352 |

8.43E-14 |

-15.91928 |

-14.51238 |

-15.34944* |

|

|

3 |

894.5497 |

33.29132 |

9.42E-14 |

-15.8165 |

-13.77011 |

-14.98764 |

|

|

4 |

925.9072 |

49.92844 |

8.46E-14 |

-15.93995 |

-13.25406 |

-14.85207 |

|

|

5 |

960.7807 |

52.14094* |

7.18e-14* |

-16.13166* |

-12.80628 |

-14.78477 |

|

Johansen Multivariate Co-integration Test

Johansen co-integrated test used as a next model with VAR optimal lag length to observe the long-run relationship existence of macroeconomic variables and stock prices.

|

Table 4 |

||||

|

Unrestricted Co-integration Rank Test (Trace) |

||||

|

Hypothesized |

Trace Statistic |

0.05 Critical Value |

Prob.** |

|

|

No. of CE(s) |

Eigen value |

|||

|

None * |

0.623 |

144.379* |

69.819 |

0.000 |

|

At most 1 |

0.234 |

44.749 |

47.856 |

0.095 |

|

At most 2 |

0.104 |

17.536 |

29.797 |

0.600 |

|

At most 3 |

0.049 |

6.335 |

15.495 |

0.656 |

|

At most 4 |

0.012 |

1.185 |

3.841 |

0.276 |

|

Table 5 Unrestricted Co-integration Rank Test |

||||

|

(Maximum Eigen value) |

||||

|

Hypothesized |

Trace Statistic |

0.05 Critical Value |

Prob.** |

|

|

No. of CE(s) |

Eigen value (Max) |

|||

|

None * |

0.623 |

99.631* |

33.877 |

0.000 |

|

At most 1 |

0.234 |

27.212 |

27.584 |

0.056 |

|

At most 2 |

0.104 |

11.202 |

21.132 |

0.627 |

|

At most 3 |

0.049 |

5.149 |

14.265 |

0.723 |

|

At most 4 |

0.012 |

1.185 |

3.841 |

0.276 |

In Table 4 the result of Trace test and Max-Eigen value test comprises the level of significance at 5% with only one co-integration equation. The result of both tests is the same. The base of both tests is on the likelihood ratio. Due to this co-integration equation, a linear combination scrutinizes of macroeconomic variables with KSE. This study observed that macroeconomic variables in the system show a long-run relationship.

|

Table-6 |

||||

|

Normalized co-integrating Coefficient |

||||

|

Co-integrating Equation |

LL |

1071.597 |

||

|

KSE |

M2 |

IFR |

INR |

EXR |

|

1 |

1.119 |

0.602 |

-1.143 |

-8.479 |

|

Std. Error |

(-0.408) |

(-0.149) |

(-0.418) |

(-0.928) |

|

T-Value |

[-2.743] |

[-4.099] |

[2.732] |

[9.132] |

LnKSE =+1.119385 LnM2+0.602014LnIFR-1.143201LnINR-8.478796LnEXR

According to the normalized equation stock prices (LnKSE) showed a significantly positive relationship with money supply (LnM2) in the long run which recommended that stock market provides evade against inflation (NiranjanPhuyal, 2016; Sohail&Zakir, 2009; Karki, 2017 and Barkat et al ., 2016).Inflation rate (LnIFR) also positively related to stock prices (Sohail & Zakir, 2009;Khalid, 2017; Karki, 2017). Interest rate (LnINR) has a negative impact on stock prices and the previous study also supported this relationship (Pilinkus & Boguslauskas, 2009; Saifullah Khan, 2017 and Achsani and Strohe, 2002). Normalized equation showed a negative sign and opposite relation between stock prices and Exchange Rate (LnEXR) in long-run (Wycliffe and Peter, 2014 and Sharma & Mahendru, 2010).

VEC Model

This model used when analysis deals with multiple time series with long-run stochastic trend, it is also known as co-integration. The short run relationship with stock return and macroeconomic variable as well as adjustment speed toward long run equilibrium level is observed by VECM estimation.The VECM equation is:

|

Table 7 Vector Error Correction Equation |

||||||

|

Coefficient |

Variable |

Coefficient Value |

Std. Error |

t-Statistic |

Prob. |

|

|

C(1) |

ECT |

-0.072* |

0.018 |

-4.115 |

0.000 |

|

|

C(2) |

KSE lag 1 |

-0.092 |

0.107 |

-0.856 |

0.395 |

|

|

C(3) |

KSE lag 2 |

-0.138 |

0.088 |

-1.556 |

0.124 |

|

|

C(4) |

KSE lag 3 |

-0.120 |

0.090 |

-1.336 |

0.186 |

|

|

C(5) |

KSE lag 4 |

-0.080 |

0.092 |

-0.877 |

0.383 |

|

|

C(6) |

KSE lag 5 |

-0.053 |

0.090 |

-0.592 |

0.555 |

|

|

C(7) |

M2 lag 1 |

0.008 |

0.101 |

0.079 |

0.937 |

|

|

C(8) |

M2 lag 2 |

0.143 |

0.120 |

1.190 |

0.238 |

|

|

C(9) |

M2 lag 3 |

0.385 |

0.113 |

3.411 |

0.001 |

|

|

C(10) |

M2 lag 4 |

0.607 |

0.109 |

5.571 |

0.000 |

|

|

C(11) |

M2 lag 5 |

0.117 |

0.095 |

1.231 |

0.222 |

|

|

C(12) |

IF lag 1 |

0.017 |

0.037 |

0.470 |

0.639 |

|

|

C(13) |

IF lag 2 |

0.036 |

0.035 |

1.044 |

0.300 |

|

|

C(14) |

IF lag 3 |

-0.002 |

0.036 |

-0.054 |

0.957 |

|

|

C(15) |

IF lag 4 |

0.022 |

0.035 |

0.626 |

0.533 |

|

|

C(16) |

IF lag 5 |

0.033 |

0.035 |

0.956 |

0.342 |

|

|

C(17) |

IN lag 1 |

-0.235 |

0.163 |

-1.437 |

0.155 |

|

|

C(18) |

IN lag 2 |

-0.082 |

0.172 |

-0.479 |

0.634 |

|

|

C(19) |

IN lag 3 |

0.200 |

0.161 |

1.239 |

0.219 |

|

|

C(20) |

IN lag 4 |

-0.172 |

0.167 |

-1.028 |

0.308 |

|

|

C(21) |

IN lag 5 |

-0.222 |

0.171 |

-1.298 |

0.198 |

|

|

C(22) |

Ex lag 1 |

-0.028 |

0.620 |

-0.045 |

0.964 |

|

|

C(23) |

Ex lag 2 |

-0.580 |

0.675 |

-0.859 |

0.393 |

|

|

C(24) |

Ex lag 3 |

-0.762 |

0.655 |

-1.163 |

0.249 |

|

|

C(25) |

Ex lag 4 |

0.457 |

0.644 |

0.709 |

0.481 |

|

|

C(26) |

Ex lag 5 |

-0.178 |

0.585 |

-0.304 |

0.762 |

|

|

C(27) |

CONSTANT |

0.014 |

0.009 |

1.610 |

0.112 |

|

|

R²-squared |

0.610 |

|||||

|

F-statistic |

4.505 |

|||||

|

Prob(F-statistic) |

0.000 |

|||||

The above table-7 presents the coefficient (C1) of the Error Coefficient term (ECT) is negatively significant. It is re-testified that variables are co-integrated. The coefficient of the error term specifies or pointed out long-run equilibrium adjustment speed whenever there is a disparity. When the stock price variate from their long-run equilibrium in the short-run, it is accurate, and the long run equilibrium is brought back. It is corrected the disequilibrium at the rate of -0.07217 shows that around 7.22% per month of the short-run deviation to the level of long-run equilibrium.

Other Diagnostic Test

Autocorrelation Test

Breusch Godfrey Lm test for Serial Correlation

Ho: no serial autocorrelation

H1: serial autocorrelation

|

F-statistic |

0.273 |

Prob. F(2,73) |

0.762 |

|

Obs*R-squared |

0.756 |

Prob. Chi-Square(2) |

0.685 |

Breusch-Godfrey test shows that R-squared is insignificant at the 5%,so Ho is not rejected. Hence the model is free from serial autocorrelation.

Heteroskedasticity Test

Ho= Heteroskedasticity is not present

H1= Heteroskedasticity is present

|

F-statistic |

0.395 |

Prob. F(26,75) |

0.995 |

|

Obs*R-squared |

12.279 |

Prob. Chi-Square(26) |

0.990 |

R-square is insignificant at 5% level so Ho cannot reject. Hence the model has homoscedasticity.

This examination discovered the long-run and short-run association between macroeconomic determining factors and stock value (KSE 100 index) of Pakistan by utilizing monthly data information for the time of 2010-2018. This investigation comprises of the selected time span informational data collection of Karachi Stock Exchange (KSE), Money Supply (M2), Inflation Rate (IFR), Interest Rate (INR) and Exchange Rate (EXR). The ADF and PP test utilized for stationarity property of the time series data information demonstrated every one of the five factors was nonstationary in level and stationary in the first difference. Johansen co-integration model used to check the long-term equilibrium connection of the stock exchange with macroeconomic factors. The VECM show is utilized to look at the short-run connection between stock price and macroeconomic factors and the speed of adjustment toward the long-run equilibrium level.

The Johansen co-integration test discloses that macroeconomic factors are co-incorporated with stock costs which mean variables a long-run relationship be present with stock price. The information investigation suggested that the macroeconomic factors in particular Inflation Rate, Interest Rate, and exchange rate standard are bound in long-run congruence connection as well as their variety inclination stock return toward vacillations. It further is seen that there is a positive connection of KSE with cash supply and expansion rate through a negative connection with inflation and interest rate. The VECM results expo monthly 7.22% reversion from long-run instability in short-run. The Wald test exhibited that by utilizing 5 lags of KSE returns has a short-lived effect on money supply.

It is concluded that a long-run relationship exist between macroeconomic variables and stock prices so on the bases of this relation predictions can be made by using this research. On the base of analysis some recommendations to enhance the performance of Karachi stock market for Government of Pakistan are; Increasing in Bank rates is not in favor of a vigorous stock market because rapid amplification in bank rate becomes the reason for inflation. Inflation is reduced the currency value,and currency value’s depreciation decreases the exchange rate of money. So we can say that Bank rates are the fundamental problem which creates the rest of problematic elements which affect the economy as well as Pakistan stock exchange. The results of this study will also helpful for domestic and foreign investors while decision making to invest in Pakistan stock exchange.

Abdul Hadi, A. R., Hamad 1, S. A., Yahya 2, M. H., & Iqbal 1, T. (2013). Examining Relationship between Palestine Stock Exchange andAmman Stock Exchange-Cointegration Approach. International Journal of Business and Management , 13.

Adam, A. M., & Tweneboah, G. (2008). Macroeconomic Factors and Stock Market Movement: Evidence from Ghana. 26.

Ahuja, A. K., Makan, C., Chauhan, S., & Kumar, A. (2012). A Study of the effect of Macroeconomic Variables on Stock Market: Indian Perspective. International business and finance , 43.

Barakat, M. R., Elgazzar, S. H., & Hanafy, K. M. (2016). Impact of Macroeconomic Variables on Stock Markets. International Journal of Economics and Finance , 13.

Bekhet, H. A., &Mugableh 1, M. I. (2012). Investigating Equilibrium Relationship between Macroeconomic Variables and Malaysian Stock Market Index through Bounds Tests Approach. International Journal of Economics and Finance , 13.

Chittedi*, K. R. (2015). Macroeconomic Variables impact on Stock Prices in a BRIC Stock Markets: An Empirical Analysis. Stock & Forex Trading , 7.

D.gay, R. (2008). Effect of macroeconomic variables on stock market returns. international business & Economics Research Journal , 8.

El-Nader 1, H. M.-N., &Alraimony 1, A. D. (2012). The Impact of Macroeconomic Factors on Amman Stock Market. International Journal of Economics and Finance , 12.

Gay, R. D. (2008). Effect Of Macroeconomic Variables on Stock Market returns. International Business & Economics Research Journal , 8.

Horobet, A., & Dumitrescu, S. (2006). On the causal relationships between monetary, financial and realmacroeconomic variables: evidence from Central and Eastern Europe. international business and finance , 22.

Hosseini, S. M., Ahmad, Z., & Lai, Y. W. (2011). The Role of Macroeconomic Variables on Stock Market Index in China and India. International Journal of Economics and Finance , 11.

Kalyanaraman 1, L., &Tuwajri 1, B. A. (2014). Macroeconomic Forces and Stock Prices. International Journal of Financial Research , 12.

Karki, D. (2017). STOCK MARKET RESPONSES TO MACROECONOMIC DYNAMICS: international economics and finance , 11.

Khalid, W., & Khan, S. (2017). Effects of Macroeconomic Variables on the StockMarket Volatility: The Pakistan Experience. International Journal of Econometrics and Financial Management, 18.

Khan, F., Muneer, S. & Anuar, M. A. (2013). Relationship between Stock Prices and Economic Variables: Sectoral Analysis. Actual Problems of Economics, 5(143), 544-553

Kotha, K. (2016). Macroeconomic Factors and the Indian Stock Market: Exploring. International Journal of Economics and Financial.

Lee, m., Yong, H. H., & Zhang, J. (2006). MACROECONOMIC VARIABLES AND STOCK MARKETINTERACTIONS: NEW ZEALAND EVIDENCE. Investment Management and Financial Innovations , 15.

MAGHAYEREH, A. (2003). Causal Relations among Stock Prices and MacroeconomicVariables in the Small, Open Economy of Jordan. JKAU: Econ. & Adm. , 10.

Maysami, R. C., Howe, L. C., & Hamzah, M. A. (2004). The relationship between Macroeconomic Variables and Stock Market Indices. Jurnal Pengurusan , 30.

Muneer, S., Ali, A. & Ahmad, R. A. (2017). Impact of Financing on Small and Medium Enterprises (SMEs) Profitability with Moderating Role of Islamic Finance. Information Management and Business Review, 9(2), 25-32

OKORO, C. O. (2017). MACROECONOMIC FACTORS AND STOCK MARKET PERFORMANCE: EVIDENCE FROM. International Journal of Social Sciences and Humanities Reviews , 9.

Osamwonyi, I. O., & Evbayiro-Osagi, E. I. (2012). The Relationship between Macroeconomic Variables andStock Market Index in Nigeria. J Economics, 9.

Ouma, W. N., & Muriu, D. P. (2014). THE IMPACT OF MACROECONOMIC VARIABLES ON STOCKMARKET RETURNS IN KENYA. International Journal of Business and Commerce , 31.

Phuyal*, N. (2016). Can Macroeconomic Variables Explain Long-Term Stock Market Movements? A Study of Nepali Capital Market. Journal of Business and Management Research , 13.

Pilinkus, D., & Boguslauskas, V. (2009). The Short-Run Relationship between Stock Market Prices and Macroeconomic. ECONOMICS OF ENGINEERING DECISIONS , 9.

Plíhal 1, T. (2016). GRANGER CAUSALITY BETWEEN STOCKMARKET AND MACROECONOMICINDICATORS: EVIDENCE FROM GERMANY. ACTA UNIVERSITATIS AGRICULTURE ET SILVICULTURE MENDELIANAE BRUNENSIS , 8.

Quadir, M. M. (2012). The Effect of Macroeconomic Variables On Stock Returns. International Journal of Economics and Financial Issues , 8.

Sahu 2, B., & Kotha, K. K. (2016). Macroeconomic Factors and the Indian Stock Market. Macroeconomic Factors and the Indian Stock Market , 11.

Shafana, M. (2012). Macroeconomic Variables Effect on Financial Sector Performance in Emerging Sri Lankan Stock Market. International Journal of Science and Research (IJSR) , 5.

Sirucek, M. (2012). Macroeconomic variables and the stock market: US review. IJCSMS International Journal of Computer Science and Management Studies , 10.

Wickremasinghe, G. B. (2006). Macroeconomic forces and stock prices. Facility of Business accounting&Finance paper , 41.

Abdul Hadi, A. R., Hamad 1, S. A., Yahya 2, M. H., & Iqbal 1, T. (2013). Examining Relationship between Palestine Stock Exchange andAmman Stock Exchange-Cointegration Approach. International Journal of Business and Management , 13.

Ahmed, S. (2008). Aggregate Economic Variables and Stock Markets in India. International Research Journal of Finance and Economics , 141-164.

Ajayi, R., & Mougoue, M. (1996). On the Dynamic Relation between Stock Prices and Exchange. The Journal of Financial Research , 193-207.

Chaudhuri, K., & Smiles, S. (2004). The stock market and aggregate economic activity: evidence from Australia. Applied Financial Economics , (14), 121-129.

Dumitrescu, S., & Horobet, A. (2008). On the Causal Relationship between Stock Prices and Exchange Rates: Evidence from Romania. Energy Journal , 1-42.

Fama, E. F. (1981). Stock returns, real activity, inflation, and money. American Economic Review , 45(4): 1089-1108.

Gan, C., Lee, M., Yong, H. H., & Zhang, J. (2006). MACROECONOMIC VARIABLES AND STOCK MARKET. Investment Management and Financial Innovations , 3(4), 89-101.

Geske, R., & Roll, R. (1983). The Fiscal and Monetary Linkage between Stock Returns and Inflation. Journal of Finance , 7-33.

Goswami, G., & Jung, S.-C. (1997 Retrieved April 2012). Stock Market and Economic Forces: Evidence From Korea. Research Gate .

Levine, R., & Zervos, S. (1996). Stock Market Development and Long-Run Growth. The World Bank Economic Review , 10(2), 323-339.

Maysami, R. c., & Koh, T. S. (2000). A Vector Error Correction Model of the Singapore Stock Market. International Review of Economics and Finance , 79-96.

Muktadir-al-Mukit, D. (2012). Effects of Interest Rate and Exchange Rate on Volatility of Market Index at Dhaka Stock. Business and Technology (Dhaka) , 1-18.

Park, S. (1997). Rationality of Negative Stock-Price Responses to Strong Economic Activity. Financial Analysts , 53(5), 52-56.

Patra, T., & Poshakwale, S. (2006). Economic Variables and Stock Market Returns Evidence from the. Applied Financial Economics , 16, 993–1005.

S, K. (2000). Portfolio Management. Delhi: Prentice-Hill.

saini, A., Habibullah, M. S., & hook law, S. (2006). Stock prices, exchange rates, and causality in Malaysia: a note. The ICFAI Journal of Financial Economics , 7-13.

Soenen, L. A., & Hennigar, E. S. (1991). An analysis of exchange rates and stock prices: the US experience between 1980 and 1986. Akron Business and Economics Review , 71-76.

Appendix

https://www.gdpinflation.com/search/label/Pakistan%20Economic%20Indicators

https://data.worldbank.org/indicator

https://www.brecorder.com/market-data/

[i] Mittal and Goyal (2012) explained the Kurtosis value was more than three mean data is not normally distributed. The fat-tailed distribution also shows that the return series entail large positive and negative returns, which are not likely to be observed in normally distributed returns (Danielsson, 2011).